I see furniture makers trapped by big minimums. They miss trends and hold costly stock. Small-batch edge banding fixes that by letting them test and move fast.

Small-batch orders let makers lower inventory, match local board colors, and launch new styles with less risk. Suppliers that act fast win repeat business and stronger margins.

I will explain why demand is rising, the sourcing problems, clear benefits, how good suppliers solve this, and why this trend will shape our market. I will use data and actions you can use today.

The Rising Demand for Small-Batch Orders in Furniture Manufacturing?

I see buyers want unique designs. They change tastes fast. Small batches let makers try and sell without heavy stock.

Small-batch demand grows because consumers want choice and faster delivery. Small factories prefer small runs to cut risk and match local tastes.

Market signals

I watch market reports and factory orders. I see the Latin America furniture market above USD 32 billion in 2022. I see steady growth into the decade. This data shows demand for finishes like edge banding will keep rising. I use this to justify investing in flexible lines and small-run services.

Why small factories prefer small batches

I meet many shop owners. They make small quantities. They avoid big stock. They want fast color matches. They want low MOQ. They want short lead times. They do not want to pay for inventory that sits. I advise suppliers to offer 50–500 m roll options and fast samples. I also note that many buyers buy by style and test it with a few dozen pieces.

| Metric | What I see | Why it matters |

|---|---|---|

| Regional furniture revenue | USD ~32.3B (2022) | Market size shows sustained demand. |

| Typical buyer | Small to mid workshops | Needs low MOQ and fast lead time |

| Buyer priority | Color match and cost | Drives repeat orders or rejects |

I conclude this section by saying I expect more small orders as buyers chase differentiation and fast cycles.

Challenges of Sourcing Small-Batch Edge Banding?

I know suppliers avoid small runs. They fear higher cost and more setups. That fear hurts small buyers.

Small-batch sourcing is hard because of MOQ, color matching, and logistics. Buyers face long lead times or wrong colors when suppliers only accept big orders. I will explain key pain points.

Supply-side constraints

I list typical constraints I see on the floor. Tooling and setup cost make small runs expensive. Inventory systems prefer bulk SKUs. Many plants run long production cycles. Some raw material suppliers ship whole containers only. These facts make it hard for a small buyer to get a quick, matched batch.

Board makers and color anchors

I track regional panel makers like Arauco and other large producers. Their product lines set local color standards. Suppliers must match those colors closely to win orders. I also see consolidation in the panel market. This affects lead times and available formats.

| Challenge | Effect on buyer | What I recommend |

|---|---|---|

| High MOQ | Small buyers cannot test new styles | Offer trial runs of 50–200 m |

| Color mismatch | Finished furniture rejected | Invest in digital color matching |

| Long lead time | Delays product launches | Keep small stock for top colors |

| Documentation | Customs delays | Provide full labels and SDS |

I think the path is clear. Suppliers must lower MOQ, speed up color approval, and offer small-stock programs to serve this section of the market.

Benefits of Small-Batch Customization for Furniture Makers?

I watch buyers win when they test new styles. They avoid dead stock. They learn market taste faster. I prefer suppliers who enable that.

Small-batch customization helps makers reduce inventory, raise margins on special runs, and respond to fast trends. The custom furniture market shows strong growth, which supports this move.

Buyer benefits in practice

I advise clients to run pilot lines. They try 20–100 units of a new finish. They track sell-through. They keep cash free. They scale the winners. This lowers risk. This also attracts design-led customers who pay more for unique finishes.

Examples and impact

I use a simple example. A shop buys a 100 m run of a new oak pattern. The shop sells a small batch of doors at a higher price. The shop repeats the order only if it sells well. This keeps cash lean. This also creates fast feedback loops for design.

| Benefit | Real example | Outcome |

|---|---|---|

| Lower inventory | 100 m trial runs | Less capital tied up |

| Faster testing | Launch in 2 weeks | Quicker market validation |

| Higher margin | Limited edition runs | Premium pricing |

| Better waste control | Only order what sells | Less scrap |

I note the global customized furniture market was valued at about USD 35.3 billion in 2024. This number shows buyers already value personalization. Suppliers that enable small batches will gain from this trend.

How Reliable Suppliers Provide Small-Batch Solutions?

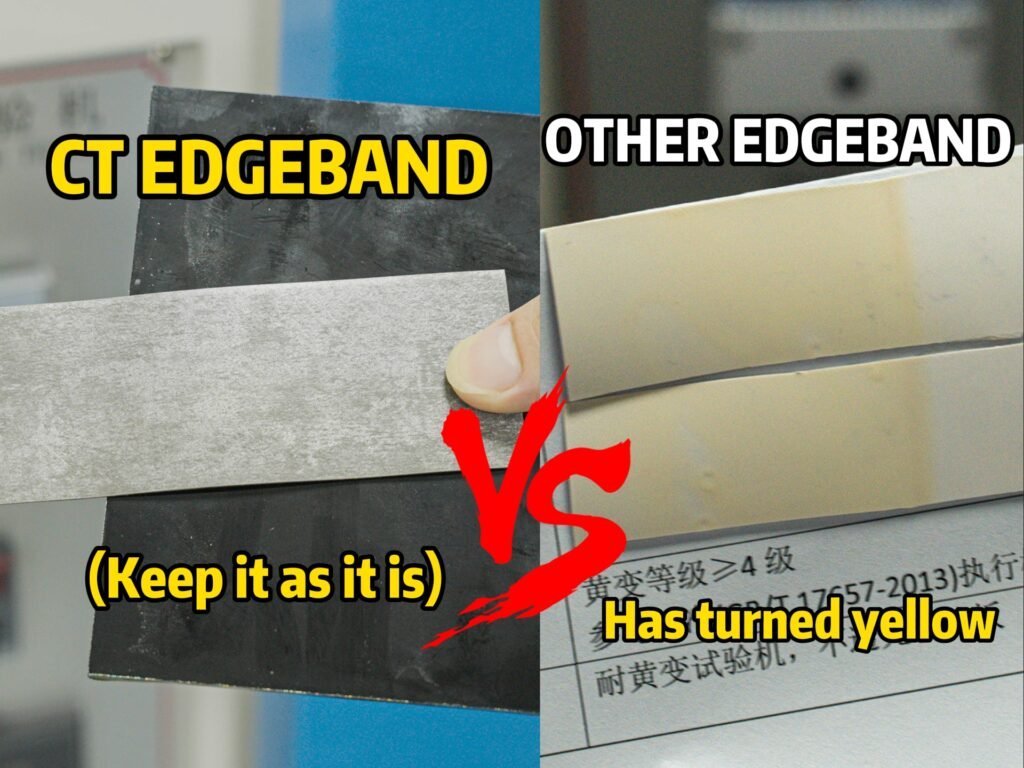

I inspect factories that succeed. They use mixed production lines. They use digital color tools. They keep a small local stock. I will list practical steps suppliers can take.

Suppliers provide value by offering low MOQ, fast samples, digital color matching, and clear compliance documents. They also help with labeling and customs support. This builds trust with small buyers.

Factory practices that work

I see three practices that matter. First, flexible lines let a factory run short batches without high cost. Second, digital color matching reduces back-and-forth and waste. Third, sample programs with clear lead times win business. These practices reduce the friction of small orders.

Compliance and documentation

I always check for third-party compliance for VOC and formaldehyde rules. I find that meeting recognized standards helps exports and high-end local buyers. Suppliers must provide test reports and labels that match buyer country rules. I use CARB regulations as a baseline for formaldehyde limits and labeling. This helps sellers ship to strict markets and reassures buyers.

| Capability | What the supplier does | Benefit to buyer |

|---|---|---|

| Low MOQ options | Offer 50–200 m roll sizes | Enables trials |

| Quick sampling | 3–7 day color samples | Faster decisions |

| Digital color lab | Spectrophotometer and recipes | Better color match |

| Compliance docs | CARB/health reports | Faster customs and buyer trust |

| Local language labels | Spanish/Portuguese on packs | Easier handling in market |

My insight: I once helped a client move from 2,000 m minimums to a 100 m trial program. The client doubled repeat orders in six months. I include this so you can replace the story with your own example.

Why Small-Batch Customization Will Shape the Future of Edge Banding Supply?

I believe the market will favor flexible supply. Buyers will pay for speed and match. Suppliers that switch will grow.

Small-batch capability aligns with rising demand and strong market growth in edge banding materials. The global edge banding materials market is estimated around USD 1.56 billion in 2025 and is projected to reach about USD 3.00 billion by 2032. This growth means more niche finishes and more demand for short runs.

Technology and scale

I see digital printing, laser edge banding, and improved adhesives as enablers. These tools cut changeover time. They reduce waste. They let small suppliers offer many SKUs cheaply.

Business model shifts

I see suppliers moving to mixed inventory. I see them holding popular matched rolls near ports. I see them offering subscription-style restock for frequent buyers. I think these shifts will make small-batch orders normal rather than special.

| Trend | Why it matters | What I recommend |

|---|---|---|

| Digital decoration | Lowers setup cost | Invest in small-run digital printers |

| Local mini-stock | Shortens lead time | Keep top 10 board matches in stock |

| Compliance-first | Removes export friction | Keep test reports ready |

| On-demand packaging | Reduces waste | Offer custom labels and barcodes |

I conclude this section by saying the numbers and tech point to a future where flexibility beats pure scale. Suppliers who adapt will capture the growing share of customization demand.

Conclusion

I believe flexible, small-batch edge banding is a practical edge for suppliers and a growth tool for makers. Act now to gain repeat customers.

Data sources and links

- Coherent Market Insights — Edge Banding Materials Market Size and Forecast 2025–2032. https://www.coherentmarketinsights.com/industry-reports/edge-banding-materials-market (coherentmarketinsights.com)

- Grand View Research — Latin America Furniture Market Size & Outlook. https://www.grandviewresearch.com/horizon/outlook/furniture-market/latin-america (Grand View Research)

- Straits Research — Customized Furniture Market Size, Share, Growth, Trends (2024–2033). https://straitsresearch.com/report/customized-furniture-market (Straits Research)

- California Air Resources Board (CARB) — Composite Wood Products Program (CARB rules on formaldehyde). https://ww2.arb.ca.gov/our-work/programs/composite-wood-products-program (ww2.arb.ca.gov)

- MarketGrowthReports — Wood Based Panel Market (Arauco and regional context). https://www.marketgrowthreports.com/market-reports/wood-based-panel-market-106881 (市场增长报告)