You buy cheap edge banding and it fails later. The problem costs time and money. I list four common pits and how I avoid them.

Four main pits wreck procurement: chasing lowest price, ignoring color and tests, trusting unverified suppliers, and skipping contracts or inspections. I explain each pit and give practical checks and sample requests.

I know this market from buying and fixing bad batches. I saw small mistakes turn into big problems. I will keep this short and clear. Read each pit and use the checklists I give.

Why Edge Banding Procurement Often Goes Wrong?

You want low cost and fast delivery. That hope causes poor choices. I want you to avoid that trap.

Many buyers miss the full cost of poor quality. The edge banding market is large and fast growing, so offers come from many sources. I use market size and trend data to explain why this matters.

Dive deeper: root causes and what I check first

I see three root causes when procurement goes wrong. I list them. I then show actions I take for each cause.

Cause 1: Narrow focus on unit price. Buyers focus on cents per meter. They forget color, glue, and waste. I always calculate landed cost. I add rework, returns, and lost time.

Cause 2: Too many unknown suppliers. The market has factories and trading companies. Many listings look good online. I verify export records and ask for factory photos and previous client names.

Cause 3: Weak quality gate before mass production. Buyers accept photos and cheap samples. Mass production then fails. I require production samples and clear test methods.

My checks before I place any PO

| Check | What I ask | Why |

|---|---|---|

| Market context | Ask about factory capacity and export clients | To know if they can deliver volume |

| Sample type | Production sample, 200–500 mm | To see real finish and glue |

| Test spec | Peel, heat, abrasion methods named | To compare with lab results |

| Contract items | Sample ID, tolerance, penalties | To protect me when batch fails |

I rely on market reports to understand supplier claims. I know Asia-Pacific leads production. I use that when I pick suppliers and when I set expectations about MOQs and lead times.

Pit 1: Chasing the Lowest Price Leads to Hidden Costs?

You see a tiny price per meter and you feel lucky. That feeling hides many costs. I avoid this trap with a simple price checklist.

The cheapest quote often comes with weak raw material, poor glue, or no QC. I show how I break down real cost and test for value.

Dive deeper: real cost calculation and material trade-offs

I always think in total landed cost. I list what I include. I then show how material choice affects cost and risk.

What I include in landed cost

- Unit price from supplier.

- Shipping and insurance.

- Import duty and local handling.

- Sample and lab test fees.

- Cost of rework and scrap in worst case.

- Cost of delayed production.

When I add those, the lowest unit price often loses. I give an example. A supplier offers $0.02 per meter for PVC. I pay $200 shipping and $100 test fees. I also lose two production days if the batches fail. The cheap unit becomes expensive.

Material trade-offs

I compare PVC and ABS. PVC is common and cheap. ABS often trims better and gives fewer machine issues. I choose material by use case. I confirm the supplier’s exact grade and processing notes before I sign.

Table: hidden cost checklist I use

| Item | How I estimate | Action |

|---|---|---|

| Rework cost | % of batch that may fail | Ask supplier for defect rate history |

| Machine downtime | Hours lost for adjustments | Schedule trial run and spare parts |

| Test cost | Lab fees | Budget tests for large orders |

| Sample cost | Paid production sample | Require paid production sample |

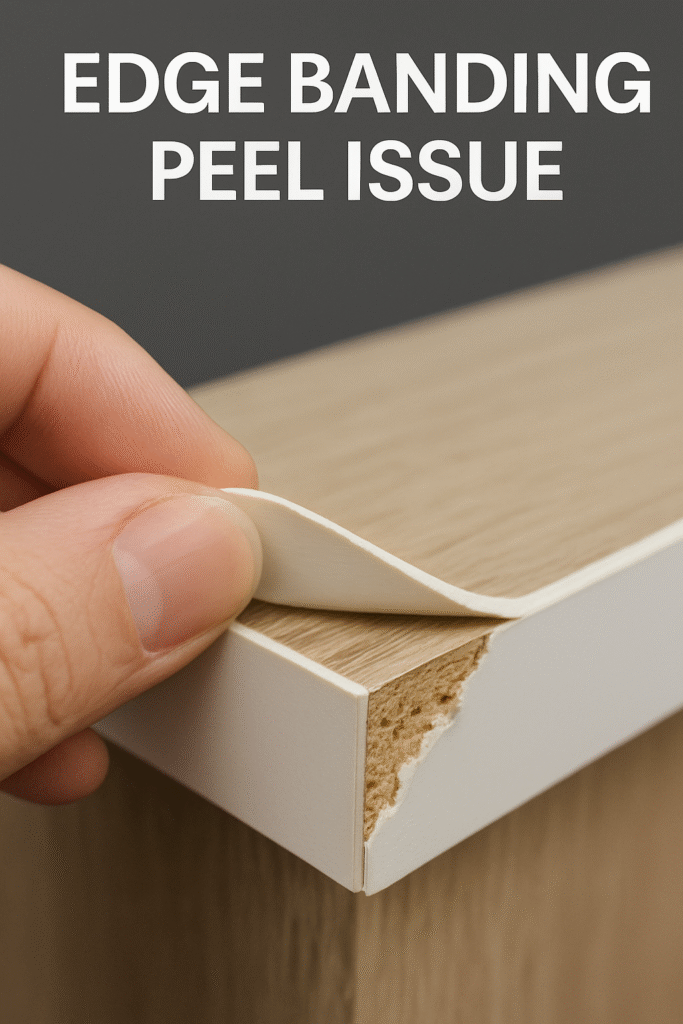

I learned this from a batch that peeled during assembly. I paid for rework and lost client trust. Since then I budget testing and include a defect clause in the contract. I recommend that you do the same.

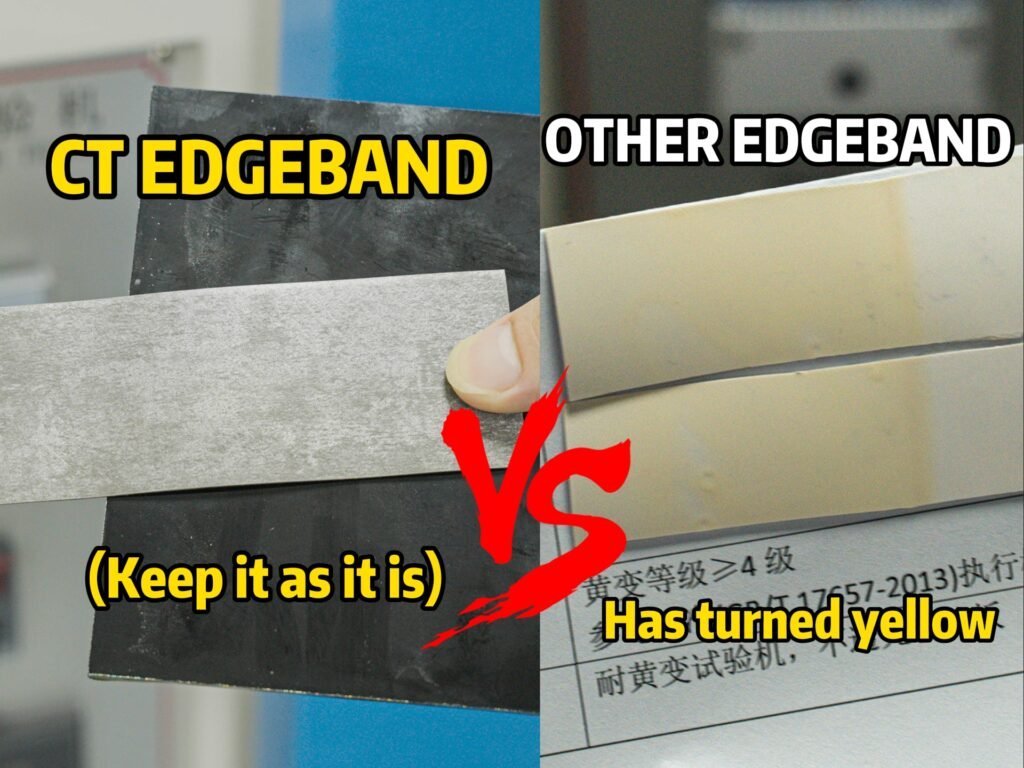

Pit 2: Ignoring Color Matching and Quality Testing?

You assume photos match color. That assumption will fail. I always demand real samples and test methods.

Color mismatch and weak adhesion are the top product issues. I use clear tests and tolerances to avoid them.

Dive deeper: tests I use and how I set acceptance criteria

I require both visual and instrument checks. I also require adhesive and heat tests. I name the standards and the lab work I expect.

Color matching

I send the exact board sample to the supplier. I ask for a production sample that we glue to the board. I measure color difference with ΔE when possible. I set an acceptance band. I also check patterns and gloss under natural and fluorescent light.

Adhesion and peel tests

I ask for peel strength tests. I name standards like ASTM D903 or ASTM D1876 as references. I ask for test results on the exact sample I approved. I do not accept generic lab reports. I send production samples to a third-party lab if I need stronger proof.

Heat and humidity tests

I ask for heat resistance numbers. I ask suppliers to report softening or delamination under set temperatures. I test glued strips in my shop with a heat gun and with hot water soak if needed.

Abrasion and finish tests

I check surface abrasion and gloss loss. I use a simple rub test for quick checks. I also ask labs for quantitative abrasion numbers for big orders.

Table: minimum tests I require for production orders

| Test | Why | My acceptance |

|---|---|---|

| ΔE color match | Visual consistency | ΔE within agreed range or visual pass |

| Peel strength | Adhesion reliability | Meet ASTM-based test on sample |

| Heat resistance | No bubbling or warp | No delam at agreed temp |

| Abrasion | Finish durability | No visible failure after rub test |

I follow these steps for every new color or finish. I also keep a test archive. I label each approved sample with batch ID. I reference that sample in the contract. This process cut my color disputes by more than half.

Pit 3: Trusting Unverified Suppliers Too Quickly?

You may talk happily with a sales rep and then trust them. Trust without verification costs you. I always verify before payment.

I verify company registration, export history, and ask for client references. I also get a factory video or inspection report. I prefer factories with traceable export records.

Dive deeper: verification steps and a supplier scorecard

I use a five-step verification process. I share the exact checks I run and the questions I ask suppliers.

Step 1 — Paper check

I ask for business license and export registration. I also ask for tax or export invoices. I verify names and addresses.

Step 2 — Product trace

I ask for product photos, machine lists, and raw material sources. I ask which brands of resin or film they use.

Step 3 — Client references

I ask for three recent clients. I call or email at least one. I ask about lead time, defect rates, and responsiveness.

Step 4 — On-site or video audit

I visit when volume justifies it. If I cannot visit, I hire a local inspector or request a timed live video showing the production line and storage.

Step 5 — Trial order and inspection

I place a small paid trial order. I book a third-party pre-shipment inspection for the trial or for the full order.

Supplier scorecard I use

| Factor | Weight | Pass threshold |

|---|---|---|

| Business verification | 20% | Registered export seller |

| Technical capability | 25% | Production line and machines match claims |

| Quality history | 20% | Low defect rate and test reports |

| Communication | 15% | Fast and technical replies |

| Inspection result | 20% | Pre-shipment checks passed |

I refuse suppliers that fail basic checks. I learned that a friendly sales rep can hide poor production. I avoid that risk by requiring visible proof.

Pit 4: Skipping Contracts and Inspection Before Shipment?

You think a simple chat or email is enough. That thought will cost you. I always use a clear PO and third-party inspection for big orders.

I put specs, sample ID, tolerance, test methods, payment terms, and penalties in the contract. I hire inspection before shipment when the value is high. This step saves me money and time.

%inspection pre-shipment edgebanding QC

Dive deeper: contract elements and inspection checklist I require

I treat the purchase order as the quality gate. I include clear references and actionable remedies. I then use inspection to enforce the contract.

Contract elements I always include

- Exact sample ID and photos attached.

- Material grade, width, thickness, and finish.

- Adhesive type and melting range.

- Acceptance tests and the test method standard.

- Payment terms and inspection holdback.

- Remedies: replacement, refund, or discount for out-of-spec.

Inspection timing and scope

I require a pre-shipment inspection for orders over my threshold. I ask the inspector to check quantity, labeling, packaging, color vs sample, and to run simple glue and visual tests. I ask for photos and a signed report.

Sample clause wording I use

I attach the approved sample as “Reference Sample ID: S-YYYYMMDD-01”. I state that any production that fails more than X% will trigger replacement. I set X based on risk and volume.

Inspection checklist I give to inspectors

| Item | What to check | Accept / Reject |

|---|---|---|

| Quantity | Count and compare with PO | Accept if within tolerance |

| Color | Compare with Reference Sample | Accept if match or within ΔE agreed |

| Adhesion | 90° or T-peel quick test | Accept if meets contract |

| Packaging | Strips wrapped and labeled | Accept if intact |

| Documentation | Test reports and labels | Accept if present and correct |

I use this contract and inspection routine for every critical order. I also keep a small funds holdback until inspection clears. This practice helped me avoid a large recall once.

Conclusion

I avoid these four pits with samples, tests, verification, and clear contracts.

Data sources (names and links)

- IMARC Group — Edge Banding Materials Market Size, 2024 report. https://www.imarcgroup.com/edge-banding-materials-market. (IMARC Group)

- Coherent Market Insights — Edge Banding Materials Market forecast 2025–2032. https://www.coherentmarketinsights.com/industry-reports/edge-banding-materials-market. (coherentmarketinsights.com)

- Ledgeband (industry guide) — Differences between ABS and PVC edge banding. https://ledgeband.com/blogs/edge-bands/understanding-differences-abs-pvc-edge-banding. (LEDGEBAND)

- EdgebandCT — Common problems with edge banding (peeling, bubbling, adhesion). https://edgebandct.com/common-problems-with-cabinet-edge-banding%EF%BC%8Chave-you-encountered-any-of-these/. (edgebandct.com)

- Instron / ASTM references — Peel strength testing (ASTM D903 / ASTM D1876) and testing guidance. https://www.instron.com/en/testing-solutions/astm-standards/astm-d903/. (Instron)