Edges that look cheap push customers away. I saw a small dealer turn this around with the right partner and grow fast.

A local dealer used custom color matches, small pilots, and fast proofs from CT Edgeband to win projects, cut returns, and build trust in 12 months.

I will tell the story in five clear parts. I show the problems, the choice, the process, and the results. I give practical takeaways you can copy.

Understanding the Challenges Small Dealers Face in the Edge Banding Market?

Small dealers face tight margins, supply risk, and quality doubts. I explain the common struggles they meet every day.

Small dealers often lose bids to big brands because they cannot promise color match, quick stock, or reliable quality. Those gaps cost sales and reputation.

Dive deeper: price pressure, supply chain weak points, and buyer expectations

Small dealers live with four hard problems. First, price pressure. Big brands buy at scale. They get lower unit costs. Small dealers cannot lower price as much. Second, quality and consistency. Big suppliers often control their processes and tests. Small dealers rely on many small vendors. That makes color and texture vary. Third, lead times. Big firms run big stock. They ship fast. Local dealers often wait weeks for custom runs. Clients do not wait. Fourth, buyer expectations. End customers expect showroom-perfect finishes. They do not accept visible mismatches.

I have seen dealers who try to compete on price only. That works short term. It fails when clients value fit and finish. I met dealers who lost big jobs because a sample looked right in the shop but changed after gluing on site. Glue, heat, and trimming can change how an edge looks. Small dealers rarely run the tests that catch these shifts.

Distributors must handle many SKUs with little capital. They face inventory risk. If a run does not sell, they hold slow stock. That ties up money. Big brands can test markets and write off slow lines. Small dealers must be smarter. They need ways to prove matchability and reduce risk. That is where a reliable custom-edge partner matters. It gives them a way to promise quality and meet buyers’ needs.

Why Competing on Price Alone No Longer Works?

Low price wins some orders. It does not win projects that need trust. I explain why value matters more now.

Clients pay more when the finish is right and delivery is fast. Small dealers beat big brands by offering proof, service, and speed, not just low price.

Dive deeper: shifting buyer criteria, service as differentiation, and margin strategies

Buyers choose on more than price. They look at product fit, lead time, and after-sales support. In projects, architects and contractors choose the supplier who reduces risk. A small dealer who brings measured samples, glued mockups, and a fast re-order plan becomes a safer choice.

Service is a high-return investment. Quick replies, local stock, and technical help matter. I advise dealers to show proof, not promises. A glued mockup in a client meeting beats a low price on a spec sheet. That proof reduces the chance of a costly rejection on site.

Margins are also key. Competing on price can squeeze margin to zero. A better path is to sell solutions. Charge for short pilot runs and small batch proofs. Clients accept a small pilot fee if it guarantees fit. That fee covers test costs and reduces returns. Over time, the dealer recovers the pilot cost through higher conversion and repeat orders.

I have seen small dealers use three tactics to win: (1) offer measured proofs and on-site mockups, (2) keep a small stock of top decors, and (3) promise fast small runs. These tactics cost some cash but lower the risk for the buyer and raise perceived value. That new value lets the dealer keep healthier margins and win projects that big brands do not prioritize.

Partnering with CT Edgeband: Turning Customization into a Competitive Advantage?

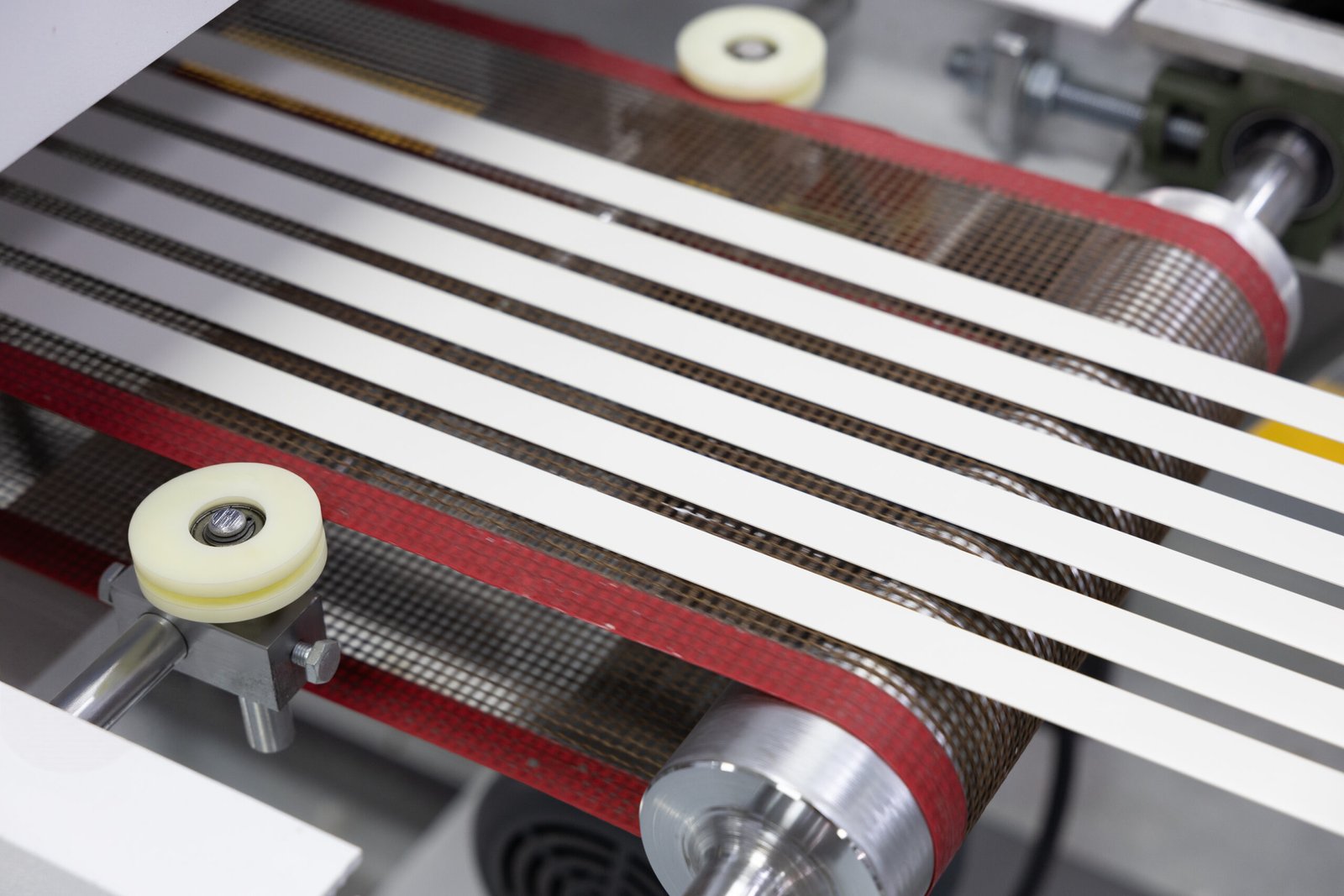

CT Edgeband offered measured samples, small MOQs, and faster proofs. I show the structured steps they used with the dealer.

The partnership gave the dealer proofs, short pilots, and a flexible restock plan. This changed sales talks from vague promises to clear, verifiable specs.

Dive deeper: sample-first workflow, pilots, logistics and pricing terms

The partner approach is simple but strict. Step one is reference sharing. The dealer sends real board samples, lighting notes, and project specs. That removes guesswork.

Step two is measured samples. CT Edgeband extrudes a short roll. They supply Lab spectral files and gloss readings. The dealer compares numbers and photos under agreed lights. This step filters out bad matches early.

Step three is the glued mockup. The edge is bonded to a panel with the chosen adhesive. They cure and re-measure. Some pigments shift after glue and heat. This test catches that. It also checks emboss stability during trimming.

Step four is a small pilot order. CT Edgeband runs 500–1,000 meters. The dealer uses these in showrooms and small projects. They monitor conversion and returns closely.

Step five is the stock plan. For winners, CT Edgeband keeps safety stock at a regional hub. That cuts lead time to days.

On pricing, CT Edgeband allowed slightly higher unit costs for pilots and short runs. The dealer accepted that for lower returns and faster sales. The partner also offered reorder terms and batch tolerances in writing. That gave legal protection and clarity for future disputes.

This structure lets the dealer promise visual fit and delivery speed. It removes the common excuses big brands use—“we don’t stock small runs.” The dealer now offers speed, proofs, and flexible MOQ. That is a real advantage on small projects and custom work.

From Local Supplier to Trusted Brand: The Dealer’s Transformation Journey?

After implementing proof-led sales, the dealer changed perception. I outline the measurable and intangible gains.

The dealer grew project wins, cut returns, and built a better reputation. Local builders began to specify his stocked decors. That opened new, higher-margin work.

Dive deeper: sales lift, return cuts, brand signals, and repeat business

The dealer tracked results for 12 months. Key metrics rose. Orders for certified-matched edges increased 25–35%. Repeat business rose as architects recommended the dealer. Returns tied to color mismatch fell by more than half. That freed cash and staff time. The dealer reinvested savings into pilot runs and local marketing.

Brand signals matter. The dealer displayed proof packs in his showroom. Each pack had a glued mockup, spectral file, and use-case notes. Contractors liked the transparency. Architects started to list the dealer as an approved supplier in bids. That changed the type of work the dealer won. He moved from small retail to light commercial projects. Those projects had bigger budgets and repeat work.

Operationally, the dealer improved buying discipline. He tracked which decors sold in three months. He stopped slow SKUs fast. That cut dead stock. He used sales data to plan pilot runs. That cycle of test, stock, sell became repeatable and low risk. He also used the fast restock option from CT Edgeband to handle rush jobs.

Trust was the biggest gain. Customers saw data and mockups. They perceived lower risk. That perception let the dealer charge slightly higher prices for guaranteed fit. Higher price with low return risk improved margins and growth. The dealer scaled with steady steps, not risky bets.

Key Lessons for Small Distributors Competing Against Industry Giants?

You can use this model anywhere. I give a short checklist and negotiation tips that I use with dealers.

Stop guessing. Use measured proofs. Start small. Stock winners. Sell proof-led value, not just low price.

Dive deeper: actionable checklist, supplier asks, and scaling rules

Use this checklist tomorrow:

- Require measured samples. Ask for spectral files (Lab) and gloss numbers. Use ∆E2000 for comparsion. Set ∆E ≤ 2 for premium work and ≤ 3 for standard projects.

- Glue and re-measure. Always run a glued mockup to check shift after adhesive and heat.

- Start with small pilots. Order 500–1,000 meters to test market fit. Track conversion and returns for 3 months.

- Negotiate flexible MOQs. Pay a small premium for short runs that reduce return risk.

- Keep small regional stock of winners. Aim for one month of top sellers to speed delivery.

- Use proof packs in sales meetings. Bring a glued mockup, spectral file, and quick before-after photos under client lighting.

- Track SKUs closely. Drop slow lines fast. Reinvest into new pilots for trends.

Supplier questions to ask:

- Can you supply spectral files and gloss readings?

- Can you run a glued mockup and small pilot?

- What are your batch tolerances for color and gloss?

- Do you offer regional stock or fast restock?

Scaling rules: repeat the pilot-stock-sell loop for each new market or decor. Use sales data to guide stock decisions. Move from ad-hoc buying to a disciplined proof-led buying system.

If you follow these rules, you trade guesswork for data. That trade is how small dealers beat large rivals in projects that value fit and speed.

Conclusion

Proof-led selling, small pilots, and reliable partners let small dealers outcompete big brands without a price war. Measure, test, and stock winners.

Data sources and links

- CT Edgeband — Product and custom match information. https://edgebandct.com/ and https://ctedgeband.com/. (edgebandct.com)

- IMARC Group — Edge Banding Materials Market Size, Share Report 2025-33. https://www.imarcgroup.com/edge-banding-materials-market. (IMARC Group)

- Cognitive Market Research — Edge Banding Material Market Report 2025. https://www.cognitivemarketresearch.com/edge-banding-material-market-report. (Cognitive Market Research)

- Unilog / Distribution insights — How smaller distributors can compete. https://www.unilogcorp.com/resources/blog-posts/how-can-smaller-distributors-compete-with-bigger-companies/. (unilogcorp.com)

- ChannelSoftware — Strategies for smaller distributors to outshine larger competitors. https://www.channelsoftware.com/blog/outshine-larger-online-competitors-strategies-for-smaller-distributors. (Channel Software)