I see the pain when orders miss deadlines. Delays cost money and trust. I want to help you avoid that.

A strong supply chain links raw materials, production, and shipping. It cuts lead time variability and keeps deliveries on schedule. This protects cash flow and customer trust.

I will walk you through why supply chains fail and what a reliable supplier does differently. I write from direct sourcing experience. I will give clear steps you can use tomorrow.

Why a Strong Supply Chain Matters for On-Time PVC Edge Banding Delivery?

I once waited six weeks for an edge banding shipment. My client lost a project. I learned this: on-time delivery is not luck. It is systems and people aligned.

A strong supply chain reduces surprises. It smooths lead times from resin purchase to packed containers. That lowers the chance of missed delivery dates.

Dive deeper

A strong supply chain matters because it controls three costly sources of delay: raw-material gaps, production variance, and transport disruption. I break them down and show how strong systems stop each.

1) Raw materials (PVC resin and additives)

PVC edge banding needs stable PVC resin supply. Resin price swings or shortages force makers to pause production. When resin is scarce, lead times jump. Savvy suppliers keep multi-sourced contracts. They hold safety stock at key points. They lock part of supply with term agreements. This reduces last-minute stops. Recent market trends show PVC capacity changes and price shifts that affect lead times. I watch such reports to gauge risk.

2) Production stability

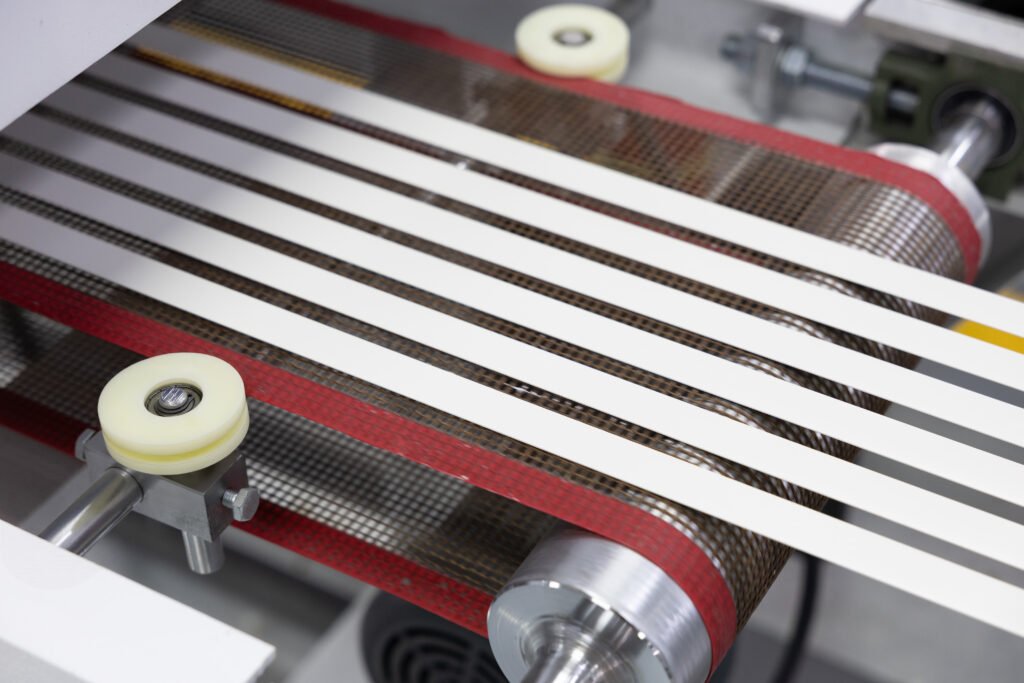

Machine uptime, quality control, and staff skills matter. A factory with planned maintenance and backup lines copes with breakdowns. I expect suppliers to publish OEE (overall equipment effectiveness) targets or at least uptime figures. They should run sample inspections and daily QC logs. When a supplier lacks these, delays often follow.

3) Transport and logistics

Ports, vessels, and carriers can cause big swings. In 2024–2025, shipping reliability dipped and transit times varied. A strong supply chain uses carrier diversification, route alternatives, and visibility tools. They track containers and push for priority when needed. If a supplier depends on a single carrier or route, expect risk.

Quick comparison table

| Risk area | Weak supply chain | Strong supply chain |

|---|---|---|

| Raw material | Single supplier, no stock | Multiple suppliers, safety stock |

| Production | Reactive maintenance | Planned maintenance, backups |

| Logistics | Single carrier, no tracking | Carrier mix, real-time visibility |

| Lead time variance | High | Low |

A strong supply chain reduces lead time variance. Lower variance means I can plan inventory with more confidence. Lower variance also means fewer emergency shipments and less rush cost. Studies show that lead time variability directly harms performance and cost. Stabilizing lead time yields measurable benefit.

Key Supply Chain Weak Points That Commonly Cause Delays for Wholesale Buyers?

I once trusted a supplier who hid poor QA. I learned the hard way. Weak links often hide behind good marketing.

Common weak points are single sourcing, low inventory transparency, poor production controls, and thin logistics planning. These create cascading delays from materials to delivery.

Dive deeper

Let us unpack each weak point. I will give signs to spot and steps to fix them.

Single sourcing for critical inputs

If a supplier relies on one resin producer or one adhesive maker, any outage there stops their line. I ask for a supplier’s sourcing map. A reliable supplier shows at least two sources for critical inputs. They also show months of safety stock or rolling purchase plans. Market reports note expansions and shifts in PVC capacity that can change supplier risk. Use those reports to judge supplier claims.

Lack of inventory transparency

Some suppliers cannot tell you real stock. They give vague answers like “plenty.” I ask for stock snapshots and reserved stock for my orders. Good suppliers use ERP systems and can share weekly inventory reports.

Poor process and QA controls

Poor QA causes rework and shipment holds. I check whether a factory uses SPC (statistical process control), in-line inspection, and batch traceability. I ask for failure rates and first-pass yield numbers. If a supplier cannot provide them, they likely have higher rework and delay risk.

Thin logistics planning

A supplier who books the cheapest carrier at the last minute is risky. I ask about carrier contracts, contingency routes, and peak-season plans. Recent shipping disruptions stressed carriers and ports. Suppliers who plan alternatives avoid big delays.

Table: Weak point, symptom, corrective action

| Weak point | Symptom you see | What I ask for |

|---|---|---|

| Single sourcing | Sudden production stop | Multiple suppliers, supply contract |

| No inventory data | Vague stock answers | Weekly inventory snapshot |

| Poor QA | High rejects | QC process, yield data |

| Logistics weak | Late shipments in peak | Carrier list, contingency plan |

I prefer suppliers who show data. If they cannot share basic KPIs, I treat them as high risk. The market shows broad supply volatility. That makes supplier transparency non-negotiable.

How Reliable Suppliers Build a Stable PVC Edge Banding Supply Chain From Raw Materials to Shipping?

When I inspect a reliable supplier, I see clear processes. They plan for common failures. They build redundancy without wasting cash.

Reliable suppliers manage raw material contracts, keep buffer stock, run disciplined production, and use logistics visibility to reduce surprises. They share KPIs and contingency plans.

Dive deeper

I will detail practical systems that show a supplier is truly reliable.

Raw material strategy

Reliable suppliers sign multi-year or rolling contracts with resin makers. They also buy from spot markets when price dips. They maintain buffer stock—often enough for several weeks of production. This reduces stoppages during tight markets. They track resin price indicators and production capacity news. These signals help them hedge and plan purchasing. Recent industry reports show capacity additions and shifting demand; a smart supplier adapts to such signals.

Production discipline

I look for documented SOPs (standard operating procedures). I expect preventive maintenance schedules and trained operator matrices. Good factories use KPI dashboards for OEE, yield, and scrap. They run pilot batches before each production run and keep records for traceability. That lowers the chance of mass rework.

Quality assurance and traceability

Traceability is key. Every lot should link to resin batch, adhesive lot, and QC tests. Reliable suppliers provide COA (certificate of analysis) and inspection photos. They accept third-party audits and quality clauses in contracts.

Logistics and visibility

Top suppliers contract with multiple carriers. They use container-tracking platforms and can show ETA changes. They plan for peak seasons and geopolitical risks. In 2024–2025, shipping reliability dipped. Suppliers with route alternatives and active tracking fared better. I expect my supplier to share tracking links and escalation contacts when a container is delayed.

Example checklist (what I require from a supplier)

| Area | Must-have proof |

|---|---|

| Sourcing | Copies of supply agreements or supplier list |

| Stock | Weekly inventory report showing reserved stock |

| Production | Maintenance plan, OEE report |

| QA | COA, inspection photos, traceability logs |

| Logistics | Carrier list, tracking links, contingency plan |

When I sign an order, I want a clear plan. I want milestones. I want visibility. That reduces stress and helps me plan cash flow.

Practical Steps Wholesale Buyers Can Take to Reduce Delivery Risks and Improve Lead Time Stability?

I used to accept vague promises. Then I tightened my buying rules. I now get better delivery performance.

Buyers should demand transparency, diversify orders, add buffers, use contractual SLAs, and monitor market signals. Simple rules cut risk and keep projects on time.

Dive deeper

Here are the exact actions I take when I buy PVC edge banding. Use these steps to lower delay risk.

1) Require supplier transparency before ordering

Ask for an onboarding packet. I want a sourcing map, inventory snapshots, and production KPIs. If a supplier refuses, I pause. Transparency is not optional.

2) Split orders and diversify

I avoid single big orders to one supplier. I split volumes across two suppliers or two plants when possible. This lowers single-point failure risk.

3) Build time buffers into schedules

I set realistic lead times with buffers for raw material and shipping delays. Use historic data to set buffer size. Lead time variability studies show that buffers reduce stockouts and emergency costs. Use research to set numbers.

4) Use contractual service levels

Include delivery windows, penalties, and escalation paths in contracts. I add acceptance tests and holdback clauses for persistent delays.

5) Monitor market signals and carriers

Watch resin price and capacity news. Watch carrier reliability reports and port congestion updates. If you see rising risk, act early—move orders forward or increase safety stock. Shipping reports from 2024–2025 show that ports and lanes can become unreliable quickly. I use carrier alerts to re-route when needed.

6) Build relationships and communicate

Treat suppliers as partners. Share your forecast and demand plan. Ask for monthly calls to review inventory and production. Partners that see your volume are likelier to prioritize you in tight times.

Simple action plan table

| Step | What to do this week |

|---|---|

| Onboard transparency | Request inventory snapshot and supplier list |

| Split orders | Move 30% of next order to second supplier |

| Buffer planning | Add 10–20% lead time buffer based on route |

| Contract update | Add delivery SLA and escalation contact |

| Market watch | Subscribe to resin and shipping reports |

I follow these steps for every large order. They keep projects moving. They cut emergency freight costs. They keep customers happy.

Conclusion

A strong, transparent supply chain is the single best way to avoid delivery delays and protect your business.

Data sources and links

- Maersk — Global Market Update and logistics insights. https://www.maersk.com/news/articles/2025/07/02/maersk-global-market-update-summer

- S&P Global Market Intelligence — Shipping delays impact global supply chains (Aug 2024). https://www.spglobal.com/market-intelligence/en/news-insights/research/shipping-delays-impact-global-supply-chains-and-exports-jul24 (S&P Global)

- ResearchGate — The Impact of Lead Time Variability on Supply Chain Management (Nov 2024). https://www.researchgate.net/publication/385731018_The_Impact_of_Lead_Time_Variability_on_Supply_Chain_Management (ResearchGate)

- McKinsey — Supply chains: Still vulnerable (2024 supply chain risk survey). https://www.mckinsey.com/capabilities/operations/our-insights/supply-chain-risk-survey (McKinsey & Company)

- Sea-Intelligence / industry reporting — 2024 shipping reliability and delays. (summary reporting). https://superdryers.com/media_posts/all-time-high-record-for-shipping-delays-in-2024/ (Super Dry)