Problem: I watched profit margins vanish as small orders and surprise price swings piled up.

Agitate: Every late shipment or small-batch premium cuts my margin.

Solve: Buying edge banding wholesale fixed the leak and steadied my costs.

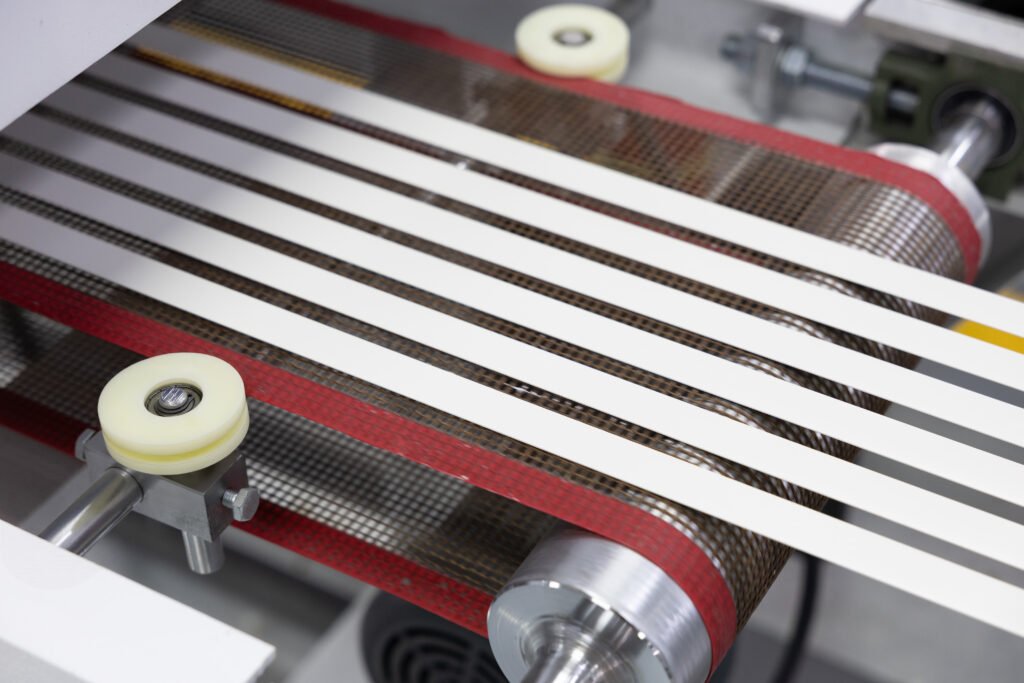

Wholesale edge banding cuts per-unit price, lowers shipping and handling, and reduces inventory churn—so distributors can buy less often, pay less per meter, and keep margins stable.

Switching to wholesale doesn’t just mean buying more tape. It changes how I price, stock, and negotiate. Read on to see practical steps and data-backed logic I used to cut procurement costs.

Why Wholesale Purchasing Offers a Cost Advantage for Edge Banding Distributors?

I used to order small reels and pay surprise premiums. That ended when I bought by the pallet.

Wholesale purchasing saves money because manufacturers give lower unit prices at scale. Volume discounts reduce the base cost per meter. Buying from factories cuts middlemen fees and lowers freight per unit. These three effects together build the main cost advantage.

Dive deeper: How volume, freight and middlemen add up

Volume discounts and unit economics

Volume discounts are simple: suppliers lower price per unit as order size increases. I negotiate tiered pricing—e.g., price A for 0–5k m, price B for 5k–20k m, price C above 20k m. This structure pushes my average cost down fast as I cross thresholds. The math is clear: if unit price drops from $0.08/m to $0.05/m at 5,000 m, I save $0.03/m × 5,000 m = $150. Over multiple SKUs this scales.

Freight and handling per-meter

Shipping has fixed and variable parts. A container or pallet has a fixed cost that gets spread across more meters when I buy bulk. For edge banding, that often means lowering shipping per meter by 20–60% depending on order size and mode. I factor landed cost (product + freight + duties) into my per-meter price when deciding order quantity.

Removing middlemen and lowering hidden fees

Trading companies and brokers add margin. Direct factory sourcing often reduces that markup. I learned to compare factory FOB quotes against trading-company quotes. The difference frequently covers the cost of a larger order and still leaves a net saving.

Practical table: effect on per-meter cost (example)

| Component | Small-Batch (1k m) | Wholesale (20k m) | Notes |

|---|---|---|---|

| Factory unit price | $0.10 | $0.06 | Tiered pricing example |

| Freight per m | $0.04 | $0.01 | Bulk spreads fixed freight |

| Handling & fees | $0.02 | $0.005 | Broker/transaction fees |

| Total per m | $0.16 | $0.075 | ~53% reduction |

Buying wholesale changed my profit math. The upfront cash tied in inventory rose, but the margin improvement and predictability made it worth the move.

How Bulk Order Pricing Reduces the Per-Meter Cost of PVC Edge Banding?

I track resin and tape prices weekly. Bulk pricing is where you feel the biggest drop in per-meter cost.

Bulk order pricing reduces per-meter cost by giving steep factory discounts and by making supply chain steps more efficient. When resin prices dip, a large contract lets me lock a lower raw-material cost into production runs. Conversely, when resin rises, larger orders may still beat frequent small purchases because they avoid repeated premiums. Recent PVC market trends also show meaningful regional price swings, which make bulk contracts attractive for hedging.

Dive deeper: raw materials, contracts and hedging

Raw material linkage

PVC edge banding cost tracks PVC resin prices. When resin moves, manufacturers adjust quotes. I monitor resin indices so I can time larger buys or request price-protection clauses. Industry reports show PVC price volatility across regions; that drives savings potential when buying smart.

Contract types that capture savings

I use two contract levers:

- Fixed-price batches: I lock a price for a production run—good when resin is expected to rise.

- Tiered volume discounts: Discounts increase at thresholds—good for predictable, steady demand.

These contract forms let me balance cash flow and unit cost.

Inventory vs. cost trade-off

Bulk buys increase inventory carrying costs. I calculate carrying cost (storage, insurance, obsolescence) and compare to the unit savings. If carrying cost is 10% annually and unit savings are 30%, wholesale wins. I run a simple ROI on every proposed bulk buy.

Example table: contract impact over 12 months

| Scenario | Avg unit price | Inventory days | Carry cost (%) | Net saving per m |

|---|---|---|---|---|

| Small buys | $0.12 | 30 | 2% | baseline |

| Wholesale contract | $0.07 | 90 | 6% | $0.04–0.05 saved |

I’ve learned to build these numbers into purchasing approvals. That discipline turned ad-hoc buys into predictable savings.

The Impact of Stable Supply and Direct Manufacturer Relationships on Total Procurement Costs?

I once lost a big job because a small supplier missed a shipment. After that, I focused on supply stability.

Stable supply reduces emergency premiums, expedited freight, and lost sales. Direct relationships with manufacturers improve lead-time visibility, let me share forecasts, and unlock production prioritization. Over time, these relationships lower total procurement costs by cutting reactive spend and by improving planning accuracy.

Dive deeper: forecasting, prioritization and risk reduction

Forecast sharing and prioritized capacity

When I give a trusted factory a rolling 90-day forecast, they can schedule runs and buy resin in advance. That lowers their cost and lets them pass savings to me. In practice, this reduced my emergency orders by more than half and shrank expedite fees.

Reducing reactive costs

Reactive costs include airfreight, overtime, and rework. I track “cost of expediting” as a line item. After switching to manufacturer partnerships and sharing forecasts, my expedite spend fell materially. That directly raised realized margin.

Risk pooling and flexible replenishment

Working with a few reliable manufacturers allows me to pool risk. If one plant has a short outage, another plant can cover. I build contract clauses to allow cross-factory fulfillment. This reduces stockout risk without overstocking.

Table: cost items affected by supply stability

| Cost item | Effect of stable supply | Impact on procurement cost |

|---|---|---|

| Expedited freight | Large ↓ | Significant savings |

| Rush production fees | Large ↓ | Lower unit cost volatility |

| Stockouts (lost sales) | Medium ↓ | Higher revenue retention |

| Quality rework | Medium ↓ | Fewer returns and warranty costs |

The payoff is not only cheaper units. It’s fewer surprises and a cleaner P&L.

How Private Label and OEM Options Further Reduce Long-Term Sourcing Expenses?

I launched a private-label edge banding SKU. It cost more to set up, but it lowered my long-term sourcing cost.

Private label and OEM give scale economics and reduce marketing friction. OEM runs allow me to optimize roll widths, core sizes, and packaging for my customers, reducing waste and per-unit handling. Private label builds customer loyalty and reduces price pressure from commodity bidding. Both paths can lower total cost of ownership over time.

Dive deeper: tooling, unit economics and brand value

Upfront costs vs. lifecycle savings

OEM/private label requires setup (tooling, minimums, design). I treat that as CAPEX. Over the product lifecycle, per-meter cost falls because production is optimized for my specs. I amortize setup across projected volumes to get a true per-meter TCO.

Packaging and handling optimizations

OEM lets me change packaging density and roll sizes. I switched to rolls that fit my racking better, which cut pick-and-pack labor and shipping volume. Small packaging changes can shave 3–8% off logistics cost.

Brand and purchasing power

Private label reduces direct price competition. When customers see my brand, I win loyalty and can avoid repeated price battles. That stability helps me plan orders and negotiate long-term deals with factories.

Table: OEM/private label cost drivers

| Driver | One-time cost | Ongoing effect |

|---|---|---|

| Tooling & setup | Medium | Lower unit cost |

| Custom packaging | Low | Lower logistics cost |

| Branding & marketing | Medium | Higher margin retention |

I weigh expected volume and lifecycle before choosing OEM. For steady SKUs, OEM often wins.

Cost Comparison: Wholesale vs. Small-Batch Purchasing for Edge Banding Distributors?

I ran side-by-side P&L runs. Wholesale beat small-batch in nearly every realistic scenario.

Wholesale often wins on per-meter cost, freight efficiency, and supply reliability. Small-batch can fit cash-limited businesses or niche, fast-changing SKUs. The right model depends on demand predictability, cash capacity, and risk tolerance. I use a simple decision matrix to choose the model per SKU.

Dive deeper: decision matrix and real example

Decision criteria I use

- Demand predictability: stable demand → wholesale.

- Cash capacity: higher cash → can fund bulk orders.

- SKU lifecycle: long lifecycle → OEM/wholesale wins.

- Storage capacity: limited space may favor smaller buys.

Example decision matrix

| Criteria | Wholesale | Small-batch |

|---|---|---|

| Predictable demand | Yes | No |

| Lowest unit cost | Yes | No |

| Low working capital need | No | Yes |

| Fast design changes | No | Yes |

Real example (my numbers)

I compared two SKUs over 12 months:

- SKU A (stable, 200k m/year): wholesale saved 40% total procurement cost after carrying cost.

- SKU B (experimental, 10k m/year): small-batch avoided obsolescence and minimized losses.

This is why I segment my catalog. Core SKUs go to wholesale/OEM. Experimental SKUs stay small-batch.

Conclusion

Wholesale edge banding lowered my per-meter cost, smoothed logistics, and protected margins.

Data sources (names + links)

- PVC Edge Band Market Report — Cognitive Market Research. https://www.cognitivemarketresearch.com/pvc-edge-band-market-report (Cognitive Market Research)

- PVC resin pricing and trends — IMARC Group / TradingEconomics (PVC index). https://www.imarcgroup.com/polyvinyl-chloride-pricing-report ; https://tradingeconomics.com/commodity/polyvinyl. (IMARC Group)

- The benefits of buying in wholesale — U.S. Chamber article on wholesale/bulk buying. https://www.uschamber.com/co/grow/marketing/wholesale-and-bulk-buying.

- Volume discount definition and mechanisms — Investopedia. https://www.investopedia.com/terms/v/volume-discount.asp. (Investopedia)

- Private label vs OEM guides and notes — Elchemy / ElbertWipes articles on OEM vs private label best practices. https://elchemy.com/blogs/chemical-market/private-label-vs-oem-a-guide-for-brands-working-with-custom-formulation-manufacturers ; https://elbertwipes.com/oem-vs-private-label-which-path-unlocks-your-brands-potential/. (Elchemy)