Problem: You need a supplier you can trust.

Agitation: Bad partners cost time, money, and reputation.

Solution: I give a clear evaluation checklist so you pick the right factory.

Working with a reliable edgeband maker means you get steady quality, on-time delivery, and predictable cost. This guide shows what I check, why it matters, and how to verify claims.

I evaluate suppliers the same way I audit a factory in person. I look at equipment, quality systems, color control, delivery records, and service. I explain each point so you can ask the right questions.

How Production Capacity and Machinery Reveal a Manufacturer’s Real Strength?

Problem: A factory can claim high output on paper.

Agitation: False claims break your schedule.

Solution: Check actual machinery and throughput.

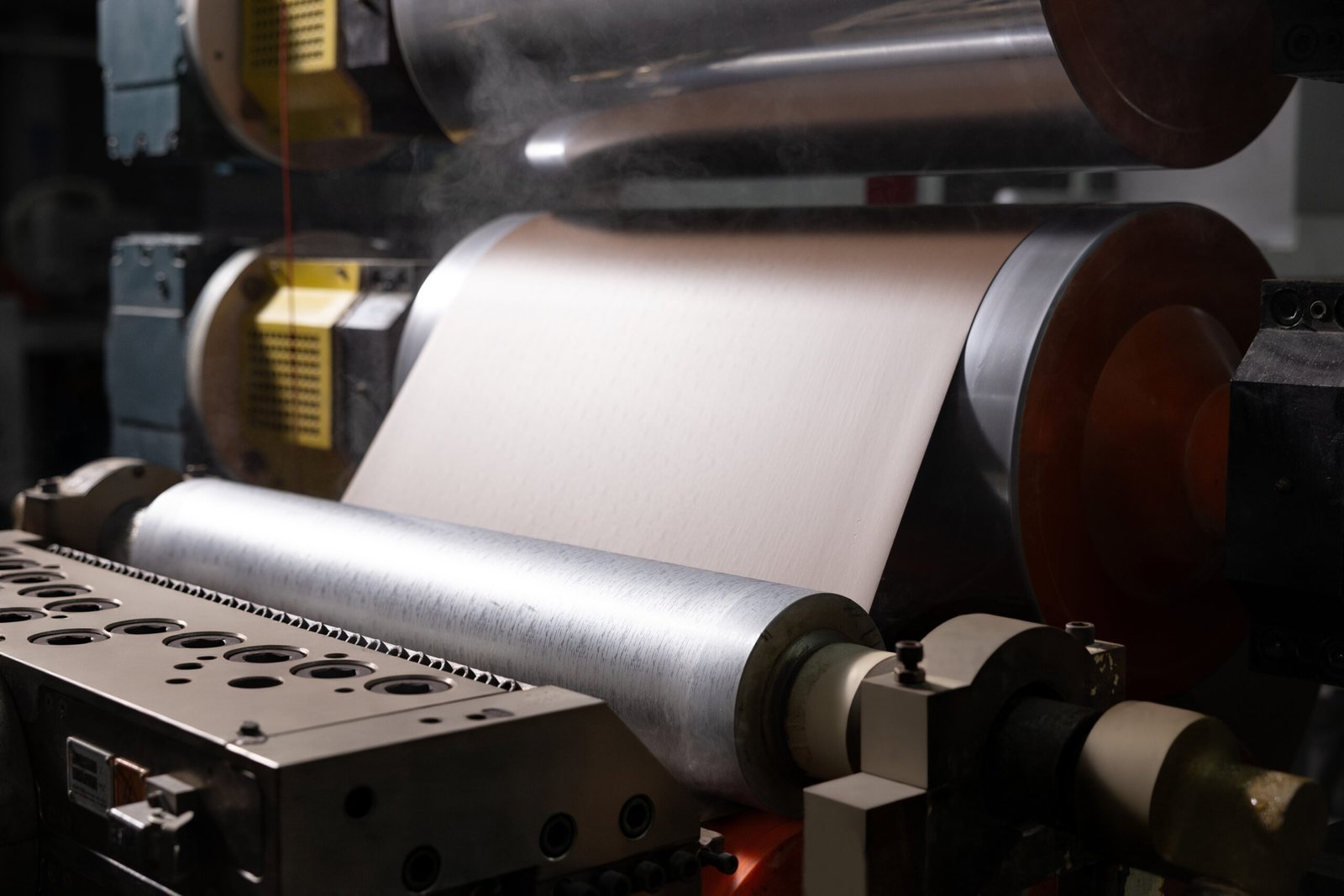

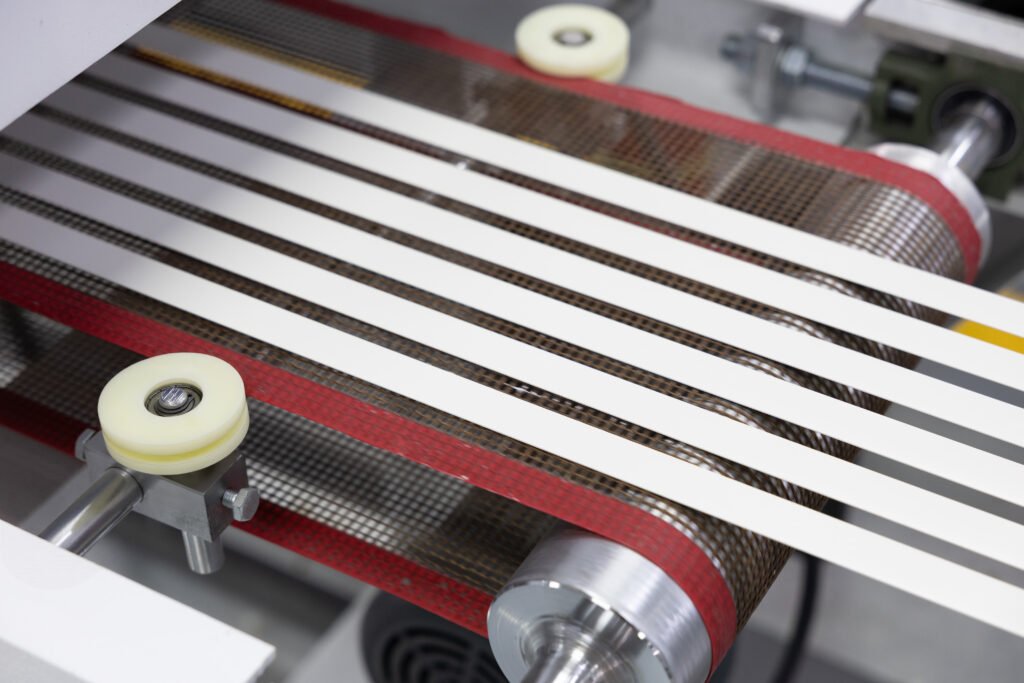

A factory’s real strength shows in its machines and throughput. I look for modern extrusion lines, stable melt pumps, and edge banding laminators. I want to see multiple lines if I plan big volumes. I also ask for current utilization rates. A plant with spare capacity can handle rush orders. One that runs at 95% capacity will struggle with urgent needs.

Dive deeper

What I inspect on site

I check the extruders. I confirm the screw size and type. I note if they use single- or twin-screw units. I ask about die tooling change time. I watch the cooling and winding stations. I check masterbatch feeders. I ask if the plant has inline spectro or camera inspection on the line.

I also ask for throughput evidence. I request recent production logs or a line-speed report. I compare claimed max output with real average output. Some vendors quote theoretical maximums. I focus on sustained throughput over a month.

Why downtime matters

Machines idle for repairs cause missed deliveries. I ask about planned maintenance schedules. I ask how fast they can fix critical parts. I want to see spare parts stock levels. A factory with a spare gearbox or screw section will recover faster than one that orders parts overseas.

Capacity vs. flexibility

High capacity matters if you buy large volumes. Flexibility matters if you need many SKUs. I prefer plants with quick-change die sets and modular tooling. These reduce change-over time. Short change-over reduces waste and lets me run smaller batches. That lowers my inventory risk.

| Checkpoint | What to ask | What it proves |

|---|---|---|

| Extruder specs | Screw size; melt output | Real mass throughput |

| Line count | Number of active lines | Scale & redundancy |

| Change-over time | Minutes per tool change | Flexibility for SKUs |

| Maintenance logs | MTTR and planned downtime | Reliability of supply |

I once moved a key line from a small plant to a larger one. The new plant had a 25% higher real output and 40% less unscheduled downtime. That change alone improved my fill rate and lowered rush freight costs.

Why Consistent Quality Systems Matter More Than Low Prices?

Problem: Low price feels good up front.

Agitation: Poor QMS means hidden costs later.

Solution: Prioritize strong processes over the cheapest quote.

A quality management system shows the factory’s discipline. I treat ISO 9001 as a baseline. I look for documented procedures, incoming inspection routines, and corrective action records. The cheapest supplier often skips these. That leads to more rework and returns.

Dive deeper

Documentation I expect

I ask for process flow charts. I ask for incoming material test records. I check batch records and QC signatures. I want to see non-conformance reports and their follow-up. A mature factory keeps corrective action logs and ID’s root causes.

Traceability and audits

Traceability links a finished roll to raw-material lots and the process log. I request batch records for past shipments. I want to see how they handled past quality issues. I look for external audit reports. A third-party audit or a customer audit gives more credibility than a certificate alone.

Cost of poor quality

Low price can be deceptive. A bad lot can stop my production line. That costs machine downtime, overtime, and expedited freight. I quantify this before I sign. I compare total landed cost, including scrap, rework, and admin. Often the slightly higher price from a certified factory is cheaper in the long run.

| Metric | What I look for | Why it matters |

|---|---|---|

| ISO / audit reports | Certificate + audit summary | Process discipline |

| Batch traceability | Material lot links | Root-cause speed |

| NCR logs | Frequency & closure time | Continuous improvement |

I remember a supplier who offered a 10% lower unit price. Their defect rate doubled in three months. The extra costs wiped out the initial saving. That taught me to value QMS stronger than a low quote.

How Color Matching, Master Samples, and Batch Tracking Prove Professionalism?

Problem: Color mismatch causes rejections.

Agitation: Without objective proof, disputes drag on.

Solution: Demand digital targets, master samples, and batch records.

Color control shows a factory’s technical level. I ask for spectrophotometer readings, master samples in light booths, and historical color trend charts. I also ask for batch records that tie each roll back to its raw-material lots and process profile.

Dive deeper

Tools and evidence I expect

I expect inline or benchtop spectrophotometer use. I ask whether they record Lab* values and which Delta E standard they use (CIEDE2000 preferred). I ask for recent color reports for the SKU I buy. I want a physical master sample stored under D50 light.

I also check how the factory handles supplier changes for masterbatch or film. I ask to see their incoming material certificates and re-test logs. If a pigment or film lot changed, they should show a re-validation record.

Traceability and customer acceptance

Batch records should show the operator, time, temperatures, line speed, and inline readouts. If the customer rejects a batch later, the factory must pull the retained sample and the batch file. That data is key to a fast root-cause analysis and to limit losses.

| Proof item | Why I request it | Red flag if missing |

|---|---|---|

| Spectro reports | Objective color readouts | Only manual visual checks |

| Master sample in booth | Standardized visual target | No master or poor lighting |

| Batch record | Full traceability | Incomplete or missing logs |

I once required trend charts for a critical color. The supplier gave me six months of daily readings. The charts proved stability. That made my QA team relax and reduced sample checks at receiving.

What On-Time Delivery and Inventory Planning Show About Supply Reliability?

Problem: Late goods force costly workarounds.

Agitation: Stockouts damage customer trust.

Solution: Review delivery KPIs and inventory planning capabilities.

Delivery performance shows operational control. I want to see on-time delivery rates and a track record of handling peaks. I check their inventory strategy. Do they offer consignment stock, JIT, or safety stock options? A partner who plans with you reduces your risk.

Dive deeper

KPIs I ask for

I ask for OTIF (on time in full) reports for the last 6–12 months. I review late delivery reasons. I check lead-time consistency. I want to know the average lead time and its variance.

I also ask how they manage capacity spikes. Can they move orders to another line? Do they maintain buffer stock of common colors? I prefer suppliers who can do small buffer runs for high-turn items.

Inventory models and collaboration

Modern supply works best as a partnership. I ask if the supplier can support JIT or Kanban. I ask for reorder points and lead-time calculations. If the supplier offers vendor-managed inventory (VMI), I evaluate their forecasting method.

| Metric | How I verify | What it tells me |

|---|---|---|

| OTIF % | Recent delivery reports | Operational consistency |

| Lead-time variance | Std dev of lead times | Predictability |

| Buffer stock policy | Stock levels for key SKUs | Resilience to spikes |

Switching to a supplier with a 95% OTIF from one at 70% reduced my expedited freight by half. That was a big saving on logistics and stress.

Why Customer Service, Technical Support, and After-Sales Response Define Long-Term Value?

Problem: A good sale can end badly without support.

Agitation: Slow tech help costs downtime.

Solution: Test the supplier’s service and support before you sign long term.

Customer service shows how the company treats problems. I test their response time on technical questions before I buy. I check if they assign a dedicated account manager. I also check warranty terms and spare parts policies.

Dive deeper

Service tests I run

I send a technical query and measure response time. I ask for a case study of a past problem and how they resolved it. I ask for escalation paths. I want clear contact points for quality, logistics, and commercial issues.

I also verify post-sale support. Do they provide spare parts kits? Do they help with color troubleshooting? Can they send a technician for urgent issues? These capabilities lower my operational risk.

Commercial terms and risk sharing

Good partners offer realistic warranty limits. They propose corrective action plans if a large issue occurs. They may offer partial credit, replacement schedules, or assistance with rework. I review these terms to ensure they match the supplier’s claimed competence.

| Service area | What I expect | Why it matters |

|---|---|---|

| Response time | <24 hours for technical issues | Minimize downtime |

| Dedicated contact | Named account manager | Faster coordination |

| After-sales policy | Clear warranty and escalation | Predictable remediation |

I once had a supplier send an engineer within 48 hours to solve a color bleeding issue. The cost of that engineer was less than my lost production from waiting. That experience convinced me to pay more for reliable service.

Conclusion

I evaluate capacity, quality systems, color control, delivery records, and support. Use these checks and you will pick a reliable edgeband partner.

Data sources & links

- X-Rite — Inline Spectrophotometers and Color Measurement.

https://www.xrite.com/categories/inline-spectrophotometers. (X-Rite) - ISO — ISO 9001 Explained (quality management basics).

https://www.iso.org/home/insights-news/resources/iso-9001-explained.html. - NetSuite — Just-in-Time (JIT) Inventory Guide.

https://www.netsuite.com/portal/resource/articles/inventory-management/just-in-time-inventory.shtml. (NetSuite) - Forbes — How After-Sales Services Transform Manufacturing (Apr 2025).

https://www.forbes.com/councils/forbestechcouncil/2025/04/01/how-after-sales-services-can-transform-your-manufacturing-business/. - SHARC Processing & Machinery — Factors for Extrusion Lines and PVC processing.

https://www.sharcpm.com/news/factors-to-consider-for-extrusion-line-for-plastic-processing/. (SHARC) - Investopedia — Just-in-Time (JIT) Definition and Notes.

https://www.investopedia.com/terms/j/jit.asp. - SupplyChainBrain — After-Sales Service value in manufacturing.

https://www.supplychainbrain.com/articles/25972-after-sales-service-an-area-where-the-customer-is-king.