Problem: Distributors lose sales when edge banding does not match local boards. I show a step-by-step plan to fix this in 2025.

To match edge banding to the South American model in 2025, focus on local board brands, current color trends, accurate sample matching, and a fast custom sample loop. This reduces rejects and speeds orders.

Read on. I break the process into clear steps you can use today.

Understanding the South American Furniture Market in 2025?

Problem: You cannot pick the right colors without market context. I explain the size and direction.

Short answer: South America’s furniture demand is growing. Buyers favor warm, natural palettes and stronger wood tones. Distributors must match these tastes and keep flexible stock.

Market numbers and what they mean

I look at market figures to set priorities. Latin America’s home furniture market was about USD 32.13 billion in 2024 and shows steady growth. This matters because more furniture sales mean more edge banding demand. (Cognitive Market Research)

The global edge banding materials market was valued at about USD 1.6 billion in 2024 and is expected to grow strongly. That growth raises competition and the need for better matching services. (IMARC Group)

One report puts Latin America’s edge banding market near USD 76.2 million in 2025, with faster growth than some other regions. That suggests opportunity for distributors who offer good color match services. (Cognitive Market Research)

Why these numbers matter to me and you

- Higher furniture spend means more orders for edges.

- Faster edge banding growth in Latin America favors suppliers who can match local boards.

- Distributors who wait on generic stock risk losing orders to those who offer matched samples.

| Metric | Figure | Implication |

|---|---|---|

| Latin America furniture market (2024) | USD 32,125.7M | More final goods => more edge demand. |

| Global edge banding market (2024) | ~USD 1.6B | Large, growing industry. |

| LatAm edge banding (2025 est.) | ~USD 76.23M | Regional opportunity for matched products. |

What I do after reading this: I prioritize the top countries (Brazil, Argentina, Chile, Colombia). I track local board suppliers and the colors they push. This focus helps me avoid stocking unpopular colors.

Key Challenges in Matching Edge Banding Colors with Local Boards?

Problem: Color mismatch leads to rejected panels and lost trust. I list the common causes.

Short answer: Variations in board finishes, textures, and local brand palettes make matching hard. Physical samples, gloss level, and lighting cause most issues.

Common causes and practical fixes

I see these recurring problems when working with South American distributors.

1) Multiple board suppliers and decors. Big board makers in the region, like Arauco, offer many TFL and melamine décors. Each décor has its own texture and depth. Edge banding must match that texture, not only color. (ARAUCO – Renewables for a Better Life)

2) Surface finish and gloss. Two samples can have the same color but different gloss. The eye notices this first. Matching gloss is as important as matching hue.

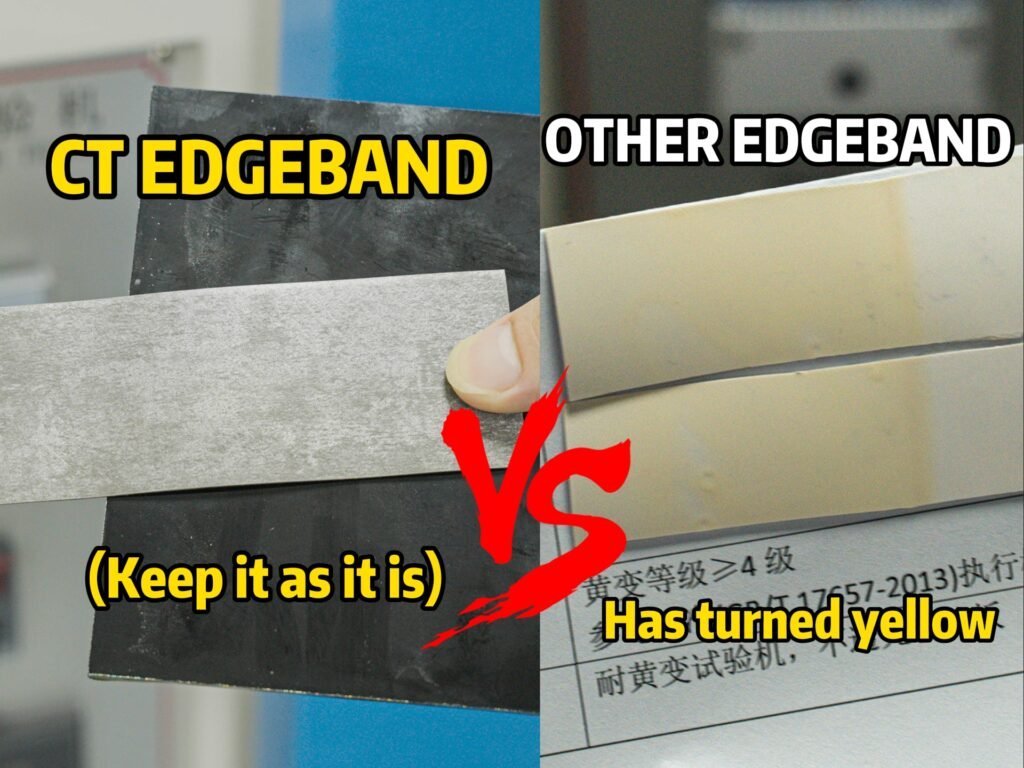

3) Batch variance in boards and edges. Boards can vary batch to batch. Edge banding master batches must be stable to reduce delta-E drift.

4) Metamerism and lighting. Samples may look different under store lights, factory lights, and daylight. This causes late rejections.

5) Digital color vs physical reality. Photos and screen images mislead. Only physical samples give a true result.

| Challenge | Why it happens | My fix |

|---|---|---|

| Many board décors | Multiple suppliers and seasonal lines | Build a board-brand library and request client samples |

| Gloss mismatch | Different finishing processes | Match gloss level and note gloss code |

| Batch drift | Raw material variation | Use master batch records and small QC runs |

| Lighting differences | Metamerism | Approve under multiple light sources |

| Digital mismatch | Screen vs real | Always send physical samples before production |

I recommend a strict sample workflow. Ask clients for a 10×10 cm board sample. I test it under D65 light and compare using a spectrophotometer. I log delta-E values and the gloss percentage. This reduces rework.

Proven Strategies for Edge Banding Color Matching in South America?

Problem: Cheap guessing wastes time and money. I describe a repeatable method that works.

Short answer: Collect local samples, run instrument checks (spectro), approve physical mockups, then produce small pilot runs. Offer quick re-runs if needed.

A step-by-step method I use

I use a clear, repeatable process for color matching. I share it so you can copy it.

- Gather local reference samples. Get slabs or small panels from the distributor or client. Include core and surface.

- Record the reference. Measure with a spectrophotometer. Note Delta-E and Lab values.

- Pick edge base polymer and gloss. Match substrate (PVC/ABS/Acrylic) and choose gloss level.

- Make digital recipe and physical proof. Produce 1–3 proof strips and send express.

- Approve and scale. After approval, run a small pilot batch. Check QC. Ship.

I once matched a woodgrain for a Chilean cabinet maker. I received a worn sample. I measured it, tuned the recipe, and sent three proofs. The client approved the second proof. We then made a 5000-meter roll run with zero rejections. This showed me how crucial fast proofs are.

Tools and metrics I rely on

- Spectrophotometer for Lab and ΔE.

- Gloss meter for sheen.

- Small pilot press for final check.

| Step | Tool | KPI |

|---|---|---|

| Reference capture | Spectrophotometer | ΔE ≤ 1.5 target |

| Gloss match | Gloss meter | Gloss within ±5% |

| Proofing | Small sample run | Visual OK under D65 |

| Pilot | Production press | <1% reject rate |

Color trends matter too. Latin American palettes now lean to warm, natural tones and localized accent colors. I follow local paint and design houses to keep my samples relevant. (El País)

How Manufacturers Support Distributors with Custom Edge Banding Solutions?

Problem: Distributors need speed and low MOQ to win customers. I explain manufacturer services that help.

Short answer: Good manufacturers offer custom color matching, low MOQ samples, stock matched collections, and fast sample shipping to the region.

Services I offer (and expect from partners)

From my factory side, I see five useful services that help distributors sell:

- Quick sample service. Make 1–3 proof strips and ship within days.

- Low MOQ custom runs. Offer small first orders.

- Color libraries mapped to local boards. Keep a digital and physical library keyed to major board brands.

- Certs and compliance. Provide CARB, REACH, and RoHS info when needed.

- Logistics and stock hubs. Place stock in regional warehouses to cut lead time.

| Service | Why it helps | How I implement it |

|---|---|---|

| Quick proof strips | Faster approvals | Dedicated proof line for samples |

| Low MOQ runs | Low risk for distributor | Flexible press scheduling |

| Board-mapped library | Faster match | Tag samples by board brand |

| Compliance docs | Faster clearance | Keep certificates updated |

| Regional stock | Shorter lead time | Partner with local warehouses |

I work with my distributors to build a “starter kit” of top 20 matched colors for each market. This kit covers about 70% of orders. Then we handle custom matches for special projects. That approach cuts response time. It also raises close rates.

Future Trends: Edge Banding and Color Matching Innovations in 2025 and Beyond?

Problem: Trends shift fast. I point out what to watch next.

Short answer: Expect bolder local accents, deeper wood tones, and demand for textured matches. Distributors should keep flexible samples and track designer palettes.

What I watch for and how I prepare

Design trends in 2025 show a move to richer, earthier tones and more expressive colors. Paint houses and designers push palettes that mix natural browns with bold accents. Distributors who update their collections every 6–12 months stay ahead. (El País)

Manufacturing tools are also improving. Better color measurement tools and tighter master-batch controls help keep ΔE low across long runs. The edge banding market’s growth makes these investments worthwhile. (IMARC Group, Cognitive Market Research)

| Trend | Impact for distributors | Action |

|---|---|---|

| Rich earth tones | More demand for dark woodgrains | Stock dark woodgrain matches |

| Bold accent colors | Lower stock coverage for niche hues | Offer fast custom proofs |

| Textured surfaces | Need texture-aware matching | Test texture on proofs |

| Faster sample cycles | Shorter approval windows | Improve logistics and express shipping |

I plan my product calendar around two types of releases: a core collection updated yearly, and a trend mini-drop every 6 months. This keeps stock fresh and reduces unsold inventory.

Conclusion

I focus on data, fast proofs, and tight QA to match South American models and win distributors in 2025.

Data sources and links:

- Cognitive Market Research — South America Home Furniture Market Report 2025. https://www.cognitivemarketresearch.com/regional-analysis/south-america-home-furniture-market-report. (Cognitive Market Research)

- IMARC Group — Edge Banding Materials Market Report. https://www.imarcgroup.com/edge-banding-materials-market. (IMARC Group)

- Cognitive Market Research — Edge Banding Material Market Report (Global & Latin America figures). https://www.cognitivemarketresearch.com/edge-banding-material-market-report. (Cognitive Market Research)

- ARAUCO — Prism TFL and product lines (example major board supplier). https://na.arauco.com/en/c/products/ct-tfl/br-prism. (ARAUCO – Renewables for a Better Life)

- El País / Comex ColorLife TRENDS 2025 — Latin America color trends (example). https://elpais.com/mexico/branded/2024-12-16/este-es-el-color-del-ano-para-transformar-tus-espacios-en-2025.html. (El País)