Problem: clients face too many edge color choices and stall. I felt that on projects. I made a clear guide to help.

Popular global edge banding patterns in 2025 center on realistic woodgrains, matte neutrals (white, anthracite), stone/concrete looks, and metal accents.

I will explain why patterns differ by market. I will list the most popular colors and textures. I will show how design and supply shape choices. I will end with practical tips you can use today.

Why Edge Banding Patterns Differ Across Global Markets?

Problem: one pattern works in one country but fails in another. I saw that on export jobs. I want to explain why.

Edge banding choice varies by local taste, supplier stock, design language, and supply chain logic.

I will dig deeper into the main causes. I will list evidence and give my view.

Local taste and culture

Manufacturers name and push decors that fit local taste. In Brazil, local collections and names like Nogueira and Carvalho appear often in catalogs. This shows local flavor matters. Duratex highlights region-first decors in its 2025 catalog.

Supplier stock and logistics

Distributors keep what sells fast. Suppliers publish “most preferred” collections to guide stocking. Kronospan and EGGER publish curated swatch packs that simplify buying. These packs make some decors common globally.

Design language and trending textures

Design trends drive choices. Textures like ribs and deep pores are growing. Finsa lists “Calypso” and “Bolero” textures in its color charts as trend responses. These textures change what edges match panels.

Trade shows and marketing

Trade fairs let designers and buyers pick favorites. AWFS and similar fairs highlight realistic woodgrains and matte neutrals. That boosts global adoption. CT Edgeband reported these trends from AWFS 2025.

My insight: I track catalogs and the fairs. I use those signals to choose stocked SKUs. That saves time and reduces rejects.

The Most Popular Edge Banding Colors and Textures Worldwide?

Problem: you want a concrete list, not vague talk. I give a practical list you can use today.

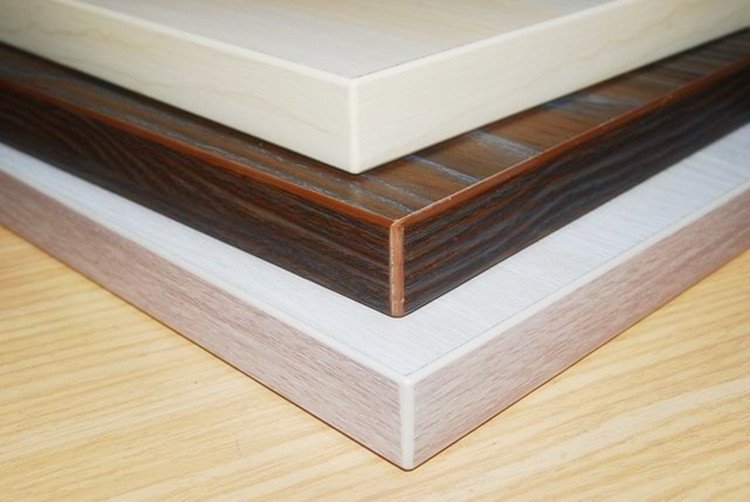

Top global patterns: realistic oak and walnut woodgrains, pure white uni, anthracite/black matt, concrete/Beton grey, light maple/sonoma, beech/birch, dark walnut variants, and metal/brushed effects.

I will explain each pattern and point to vendor examples.

Realistic oak and Halifax Oak family

I see Halifax Oak used widely. EGGER lists Halifax Oak across TFL and matching edge bands. This makes it a default for Scandinavian and modern work. Vendors promote these decors in integrated ranges.

Natural walnut and dark walnut families

I see walnut used in premium cabinets and offices. Kronospan and Duratex show walnut decors in their “most preferred” sets and catalogs. These names repeat in regional portfolios.

Pure White and Uni Whites

I see pure white unicolors in almost every market. EGGER and others offer matching uni edges for fast fit. White sells fast because it fits many designs.

Anthracite and Black Matt

I see anthracite in modern kitchens. Matte dark unis provide contrast. Suppliers list these as stocked uni colors.

Concrete / Beton and Stone Effects

I see concrete finishes in industrial designs. EGGER and other vendors push stone replicas and matching edges. This trend is visible in recent collections.

Light woods, beech, and sonoma

I see light maple, beech, and Sonoma oak across budgets. These decors are common in Kronodesign and regional catalogs.

Metal and Brushed Effects

I see metal-look edges used as accents. Vendors include metal textures among accent edgebands and catalogs. These work well on contrast designs.

My insight: I keep a short list of ten go-to edge codes. I match those to panel suppliers. This reduces rework and speeds delivery.

Regional Preferences: How Edge Banding Trends Vary by Continent?

Problem: a one-size-fits-all palette fails in global projects. I explain regional differences with examples.

Europe leans to subtle woodgrains and texture sync. South America shows strong local wood names. North America favors fast fulfillment and stocked unis. Asia mixes both fast trends and local taste.

I will break down what I watch in each region.

Europe

Manufacturers in Europe focus on tight decor systems. EGGER and Kronospan publish coordinated TFL, laminate, and edge systems. This creates strong decor pairs for designers. European buyers value texture sync and real-feel pores.

South America

I see Brazil as a strong local market. Duratex and local mills promote names like Nogueira and Carvalho. These names match local taste. Local catalogs and expo launches matter here.

North America

I see US buyers value stocked SKUs and fast lead times. US distributors emphasize immediate delivery and consistent matches. CT Edgeband highlighted the need for fast fulfillment at AWFS 2025.

Asia and Oceania

I see mixed demands. Some markets follow European texture trends. Others favor local woods and lacquered finishes. Suppliers often offer both global swatches and local packs.

What this means for buyers

I advise buyers to research supplier catalogs for each region. I advise to request local swatch packs. I also advise to check distributor stock lists before quoting.

My insight: I treat each export job as regional work. I ask distributors for their top ten stocked edge codes. That prevents surprises.

The Role of Furniture Design in Shaping Edge Banding Demand?

Problem: edges do not exist in a vacuum. I show how design choices force edge choices.

Furniture design sets the palette. Designers pick front finishes, textures, and edges follow. The market responds with matching edge systems and stocked packs.

I will explain the link between design and supply dynamics.

Design first, edge follows

Designers pick surface first. Suppliers then propose matching edges. EGGER publishes decor match systems that show the paired edge codes. This practice tightens the design-to-supply path.

Market size and growth influence choices

Growth in panels and furniture drives more edge options. Market forecasts show the edge banding market growing into the mid billions by the early 2030s. This growth pushes suppliers to expand collections and stock key decors.

Texture, finish, and perceived value

Designers use texture and pore to communicate quality. Synchronized pore edges make panels look like solid wood. Vendors add feelwood edge bands to mimic the real cut grain. That raises perceived value and demand.

My insight: I read design briefs first. I match edges to the brief, not only to the color. I test texture and light. That gives a better final product.

Practical Advice for Choosing Edge Banding Patterns for International Projects?

Problem: you need an action list, not theory. I give steps I use on every job.

Get the exact vendor code, order small samples, check texture and pore, confirm local stock, and test under project light. Use curated “most preferred” packs when possible.

I will give a step-by-step checklist you can copy.

Step 1 — Ask for the vendor “Decor Match” code

I ask the panel supplier for the decor match. EGGER and others publish exact edge codes that match each TFL or laminate. Use those codes in quotes and orders.

Step 2 — Order physical samples

I order 100 mm edge strips and a panel sample. I compare them under the project lights. I take photos from multiple angles. This step catches tone and sheen shifts.

Step 3 — Check distributor stock and lead time

I call local distributors for stock lists. I prefer stocked SKUs. Fast fulfillment reduces rework. CT Edgeband highlighted this need at AWFS 2025.

Step 4 — Verify texture and pore registration

I check if the edge has synchronized pore. I ask suppliers for texture codes. I prefer synchronized pore for high-end work.

Step 5 — Keep a short go-to list

I keep ten go-to edge codes that I trust. I keep local stock information for each. This saves time on repeat projects.

My insight: these steps cut mistakes. I use them on export and local jobs. They reduce returns and increase client trust.

Conclusion

I listed global patterns, regional differences, and practical steps to choose edges. Use vendor match codes and samples to avoid risk.

Data sources (names + links)

- EGGER — Edge Banding / Decorative Collection (decor match system): https://www.egger.com/en/decorative-collection/edge-banding?lci=bmM9bmF3MSAg egger.com

- Kronospan — Kronodesign / Most Preferred decors: https://kronospan.com/en_US/decors/by_collection/kronodesign/most-preferred kronospan.com

- Duratex — Catalogo 2025 (Duratex catalog PDF): https://duratex-madeira-prd-images-bucket.s3.amazonaws.com/2025/02/CATALOGO-2025-DURATEX.pdf duratex-madeira-prd-images-bucket.s3.amazonaws.com

- Finsa — Colour chart and texture info (Calypso, Bolero): https://www.finsa.com/en/downloads Finsa

- CT Edgeband — Top edgebanding trends from AWFS 2025: https://www.ctedgeband.com/blog/top-5-edgebanding-trends-from-awfs-2025 CT Edge Band

- Coherent Market Insights — Edge Banding Materials Market Size and Forecast 2025–2032: https://www.coherentmarketinsights.com/industry-reports/edge-banding-materials-market Coherent Market Insights

- Transparency Market Research — Global Edge Banding Materials Market Outlook: https://www.transparencymarketresearch.com/global-edge-banding-materials-market.html