Struggling with bad batches from suppliers? I faced that too and lost time and money.

This guide shows the precise audit checks I run to pick a reliable PVC edge banding supplier. It stops surprises and keeps my line running.

Before you walk into a factory, prepare a checklist. I share mine below. My insight: audits work best when you combine documents, spot tests, and a short pilot order.

What Furniture Manufacturers Must Check Before Auditing a PVC Edge Banding Supplier?

Worried you will miss a hidden problem? I was. A bad plan wastes the visit.

Check documents, samples, and recent order history before you step on the floor.

Dive deeper

I divide pre-audit checks into three parts: paperwork, sample plan, and logistics. I always start by asking for documents. Then I plan the tests I will run on-site.

Paperwork

First, ask for ISO 9001 and ISO 14001 certificates. These show the supplier uses basic quality and environmental systems. Next, ask for product test reports. I request peel strength, thermal softening point, and VOC or formaldehyde test reports if the supplier attaches edging to panels. For North American or EU buyers, CARB/TSCA or EN-related reports matter. If the supplier sells into regulated markets, they should have those reports. I check issue dates and scope. Old or generic certificates are a red flag.

Sample plan

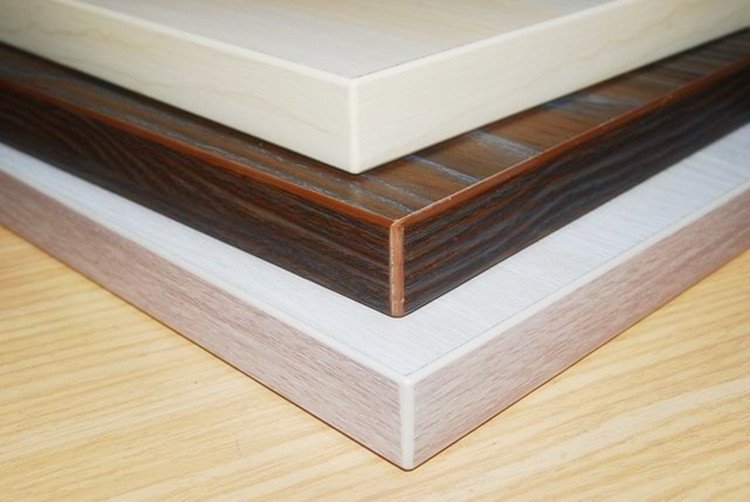

I ask for physical samples for each decor I plan to buy. Photos are not enough. I write down the tests I will perform. My list includes a color check under D65 light, hot-bond adhesion at our machine temperature, and a thickness tolerance check at multiple points. I also ask the supplier to send recent production samples with batch codes. If they refuse, I push back. A serious supplier will support a test plan.

Logistics and references

I ask for references from three recent buyers with similar volume. I verify the references by phone or email. I also ask for recent PO examples, showing order size and lead time. This reveals whether the supplier really delivered on similar orders. Finally, I confirm who will attend the audit, and what production lines I will see. If they limit access, I treat it as a warning.

I use a pre-audit document checklist so I do not forget items on the day. This step saves time and focuses the on-site audit.

How to Evaluate Production Capacity, Machinery, and Process Control During the Audit?

Afraid the supplier will promise more than they can deliver? I was. Machines and shifts tell the real story.

Count lines, confirm shift patterns, and ask for recent throughput logs.

Dive deeper

On-site I inspect extrusion lines, printing units, embossing rollers, slitting machines, and rewind stations. I also check storage and handling. I look for evidence of uptime, not just shiny machines.

Machine inventory and condition

I list machine types and counts. I ask for production capacity per line in meters per day. I do not accept vague claims. I ask to see recent production logs or machine run sheets. These logs show real output and downtime. I check for wear and polymer build-up on the extrusion heads. Poor maintenance increases variation. I look for spare parts and tooling availability. A factory with spare dies and spare rollers recovers faster from breakdowns.

Process control and records

I ask for process parameters for recent runs: melt temperature, line speed, cooling profile, and slitting tension. A good supplier keeps these records. I also check printing repeat length records and embossing settings for textured decors. Consistent process data means they can reproduce a run. I also look at in-line QC stations. Do they measure thickness and print registration during runs? Do they log nonconformances and corrective actions? If records exist, I review how they handled the last quality issue.

Shift patterns and workforce

I confirm if they run one, two, or three shifts. I ask how they handle holiday slowdowns. Many suppliers increase lead times during peak seasons. I ask about operator skill levels and training records. Skilled operators matter for both quality and fast recovery.

Storage, packaging, and stock

I inspect the warehouse. Edge banding must be stored on clean, dry racks away from sunlight. I check how they label batches and how long rolls sit before shipping. I also examine packing quality. Good packing prevents transport damage and saves you time.

Proof through pilot order

When I see good machines and records, I still run a 1–2 pallet pilot PO. The pilot confirms throughput and packaging, and it exposes hidden problems before volume commitments.

This process shows me whether the supplier can deliver the volumes and the consistency I need.

Why Quality Management Systems Reveal the Supplier’s Real Stability?

Think certificates are enough? I did once. Certificates help. Records prove the system works.

Look for corrective action logs, traceability, and incoming inspection records.

Dive deeper

I treat the quality system as living evidence. I check three things: documentation, traceability, and improvement records.

Documentation and procedures

I ask to see work instructions for extrusion, printing, embossing, and slitting. I want to see defined acceptance criteria for thickness, color, and bonding. Procedures should show who signs off at each step. If procedures are vague or missing, the supplier relies on individual experience and not on stable processes.

Traceability

Every production roll should have a batch number, raw material lot numbers, and operator ID. I trace a few finished rolls back to their raw material. Good traceability helps when you face a defect. I also check if they keep retained sample rolls from each run for a set period. These samples help root cause analysis.

Nonconformance and corrective action

I ask to see recent nonconformance reports and their corrective action plans. I look for evidence that they applied corrective actions and monitored their effectiveness. If a supplier has repeated similar defects without effective fixes, that means they lack learning. I prefer suppliers that document root causes, actions, and verification.

Internal audits and management review

I ask for recent internal audit reports and management review minutes. These show whether leadership knows the plant issues and acts on them. If management ignores audit findings, the system is only for show.

Third-party verification

ISO 9001 certification is helpful. I still ask for audit findings and the corrective action history. I also value third-party product tests from labs like SGS or Intertek. A supplier that shares third-party test reports shows transparency.

A strong quality system reduces surprises and keeps defect rates low.

What Certifications, Compliance Records, and Material Traceability Tell You About Risk?

Worried about legal or market rejections? I was. Certifications reduce product and regulatory risk.

Verify CARB/TSCA, EN standards, and social audits when needed.

Dive deeper

I check regulatory and social compliance in three areas: emissions/chemical, product standards, and social responsibility.

Emissions and chemical safety

If your furniture will be sold in the US or EU, you must check formaldehyde and VOC reports. CARB Phase 2 and EPA/TSCA Title VI set limits for composite wood products. Even if the supplier only provides PVC strip, your finished product may need to meet composite wood rules when combined with panels. I ask for formaldehyde or VOC testing when the supplier supplies glued assemblies or if their products will be used on panels that fall under regulation. I also ask if they use certified adhesives and whether they track raw material MSDS.

Product standards and lab tests

I request peel strength, thermal softening data, and abrasion results from accredited labs. These tests show whether the edge banding meets functional needs. I verify the lab names and test dates. I prefer recent reports done by SGS, Intertek, or equivalent labs. I also look for EN or ISO test alignment if you sell in Europe.

Social and ethical audits

For many buyers, SMETA, BSCI, or Sedex profiles are essential. These audits cover labor, safety, and environmental practices. I request the latest audit reports and review open findings and closure timelines. A current audit with closed findings reduces the risk of supply disruption from social issues.

Material traceability

I verify that resin and pigment suppliers are listed and that raw material certificates exist. If a PVC batch causes a failure, you must trace the issue to the raw supplier. I ask for raw material lot numbers and supplier contacts when possible.

Red flags

Expired certificates, generic lab reports without lab contact info, missing raw material traceability, and refusal to show audit reports are all red flags. If these appear, I either require corrective actions before a PO or I walk away.

These checks manage both legal risk and quality risk.

How to Compare Pricing, MOQs, Lead Times, and After-Sales Support After the Audit?

Wonder if a cheaper quote hides risk? I did. Low price without clear terms often costs more later.

Compare total landed cost, MOQ flexibility, and the supplier’s claims process.

Dive deeper

After the audit I run a commercial comparison. I look at price detail, MOQs, lead times, stock options, and after-sales.

Price transparency

I ask for a detailed quote. The quote should list raw material surcharges, setup fees, printing repeat fees, slitting and rewind costs, and packaging charges. If the quote only shows a single number, I ask what is included and what can change. PVC resin and pigment prices move. I prefer suppliers that specify how surcharges are handled.

MOQ and trial runs

MOQ affects inventory risk. I try to negotiate a pilot MOQ for the first production. If the supplier demands a high MOQ with no pilot flexibility, I push for refundable sample fees or smaller initial lots at a higher price. Many suppliers accept this if you explain future volume potential.

Lead times and stock programs

I confirm realistic lead times based on their demonstrated throughput. I ask if they offer stock programs for my main SKUs. A stock program shortens lead times and reduces risk. I also check how they handle rush orders.

Claims, warranties, and remedies

I insist on a written claims process. The PO should state claim windows, evidence required, and remedies like replacement, credit, or rework. I also agree on retained sample return policies and who pays for return shipping. Clear terms reduce disputes and speed resolution.

Total landed cost analysis

I calculate the landed cost including freight, duties, inspection fees, rework risk estimates, and storage costs. A lower unit price often hides higher indirect costs. I choose suppliers that offer clear, fixed terms for at least the first contract period.

I finalize supplier choice only after the pilot order and a satisfactory sample acceptance.

Conclusion

I audit suppliers by documents, floor checks, lab tests, and a pilot PO. Do this first. It saves time and prevents defects.

Data sources and links

- California Air Resources Board — Composite Wood Products (CARB). https://ww2.arb.ca.gov/our-work/programs/composite-wood-products-program. (ww2.arb.ca.gov)

- U.S. EPA — Formaldehyde emission standards for composite wood products (TSCA Title VI). https://www.epa.gov/formaldehyde/formaldehyde-emission-standards-composite-wood-products. (环境保护局)

- Sedex — SMETA audit overview. https://www.sedex.com/solutions/smeta-audit/. (Sedex)

- Eurofins — Guide to the SMETA audit process. https://www.eurofins.com/assurance/resources/articles/your-guide-to-the-smeta-audit-process/. (eurofins.com)

- Bestingroup — Buying edge banding: recommended certifications (ISO 9001, CARB/TSCA). https://www.bestingroup.com/buy-edge-banding-from-china-ultimate-guide/. (bestingroup.com)

- EdgeBandCT — Sourcing and red flags for PVC edge banding suppliers. https://edgebandct.com/key-red-flags-that-indicate-a-pvc-edge-banding-supplier-is-not-reliable/. (edgebandct.com)

- V-Trust — Supplier audit services for panel furniture. https://www.v-trust.com/en/industries/hardline-product/panel-furniture-quality-control. (V-TRUST)