I see the problem: furniture makers face rising demand but also rising returns and complaints. I want to help you spot where edge banding fits and how to profit.

South America’s furniture market will grow through 2030. Buyers will favor natural textures, sustainability, and custom finishes. That creates clear edge banding opportunities in materials, digital printing, and durable adhesives.

Keep reading. I will walk you through the design trends, the specific demands they create, the fastest growth markets, practical moves for distributors and factories, and the sustainable and digital tech to watch.

How South America’s Furniture Design Trends Are Evolving Toward 2030?

I hear the same design requests from clients. They want natural textures, local craft touches, and modern function. They also want durable pieces priced right.

Design is moving from plain mass production toward textured and mixed-material pieces. Buyers choose wood looks, tactile fabrics, woven rattan, and stone-like laminates. They want pieces that feel local and real. Many also want furniture that lasts and that uses safer materials. The rise of e-commerce and urban apartments pushes compact, multifunctional furniture too.

Dive deeper — specific trends, buyer needs, and what they mean for edge banding

I track four clear trends that will shape edge banding demand:

1) Natural and textured surfaces

Customers want natural wood grains and tactile surfaces. They also want consistent color and grain across panels and edges. This raises demand for wood-look edge bands and high-quality printed edges that match panels precisely.

2) Compact, multifunctional furniture

Smaller homes mean more modular furniture. That drives a need for durable edges that resist daily wear. Distributors will prefer edge bands that stand up to heavy use and tight assembly processes.

3) Local craft and artisanal touches

Designers blend local techniques with modern finishes. This trend creates demand for custom edge textures, slim profiles, and mixed-material edges (wood veneer + PVC or metal look strips).

4) Sustainability and safer materials

Buyers and export clients push for low-VOC materials and recycled substrates. This creates room for eco-friendly edge bands and certified adhesives. Brands that can show data on material safety win more contracts.

I use a simple table when I evaluate a new product line:

| Trend | What buyers want | Edge banding implication |

|---|---|---|

| Natural look | wood grain, tactile feel | wood-print or real veneer edges, close color match |

| Compact furniture | high use, tight joins | durable PVC/PP or PUR-bonded edges |

| Local craft | unique textures, small batches | custom-printed edges, small-batch supply |

| Sustainability | low VOC, recycled | certified materials, green adhesives required |

These trends change how I speak to buyers. I show samples that match panel faces. I also show durability test results. When I do this, clients move from “maybe” to “order.”

Why These Trends Create New Demands for Edge Banding Innovation?

Trends change what edge bands must do. Customers want looks plus performance. That forces innovation in prints, materials, and adhesives.

Designers expect seamless matching of edges to panels. They also expect edges to resist humidity and heavy use. Digital printing and laser/zero-gap bonding answer many of these requests. High-performance adhesives like PUR reduce failures in humid zones. These changes let suppliers charge more and win better customers.

Dive deeper — what innovation is needed and where it pays

Innovation falls into three buckets: aesthetic tech, performance materials, and process improvements.

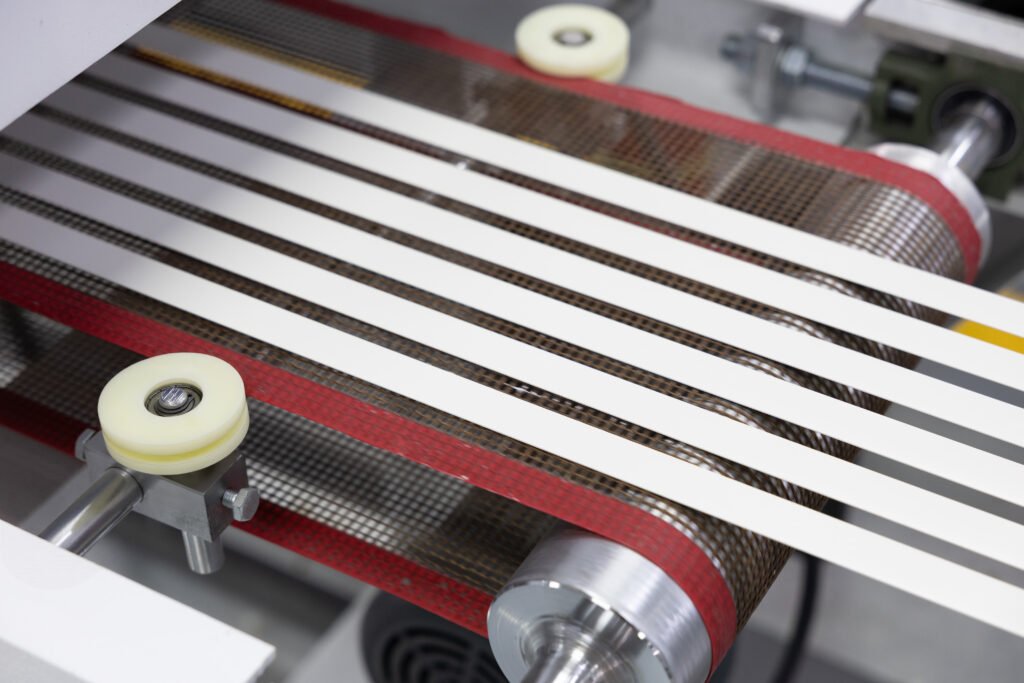

Aesthetic tech: digital printing and customization

Digital printing lets you match wood grain, marble, or custom patterns precisely. It also supports small runs and fast sample approval. For South America, digital printed edges enable local designers to get specific looks without huge MOQ. This helps distributors offer “design-matched” packages to furniture makers.

Key point: digital print reduces color mismatch disputes. That alone lowers returns and saves money.

Performance materials: PP, ABS, advanced PVC, and veneer systems

- PP and ABS offer better dimensional stability in heat than cheap PVC.

- High-grade PVC with low shrink specification works when cost is tight.

- Veneer systems need good sealing and substrate control for tropical climates.

Many buyers pay a premium for materials that last in humid areas. Switching to slightly higher-cost edge bands can reduce after-sales costs. Market forecasts show growing spend in premium edge materials.

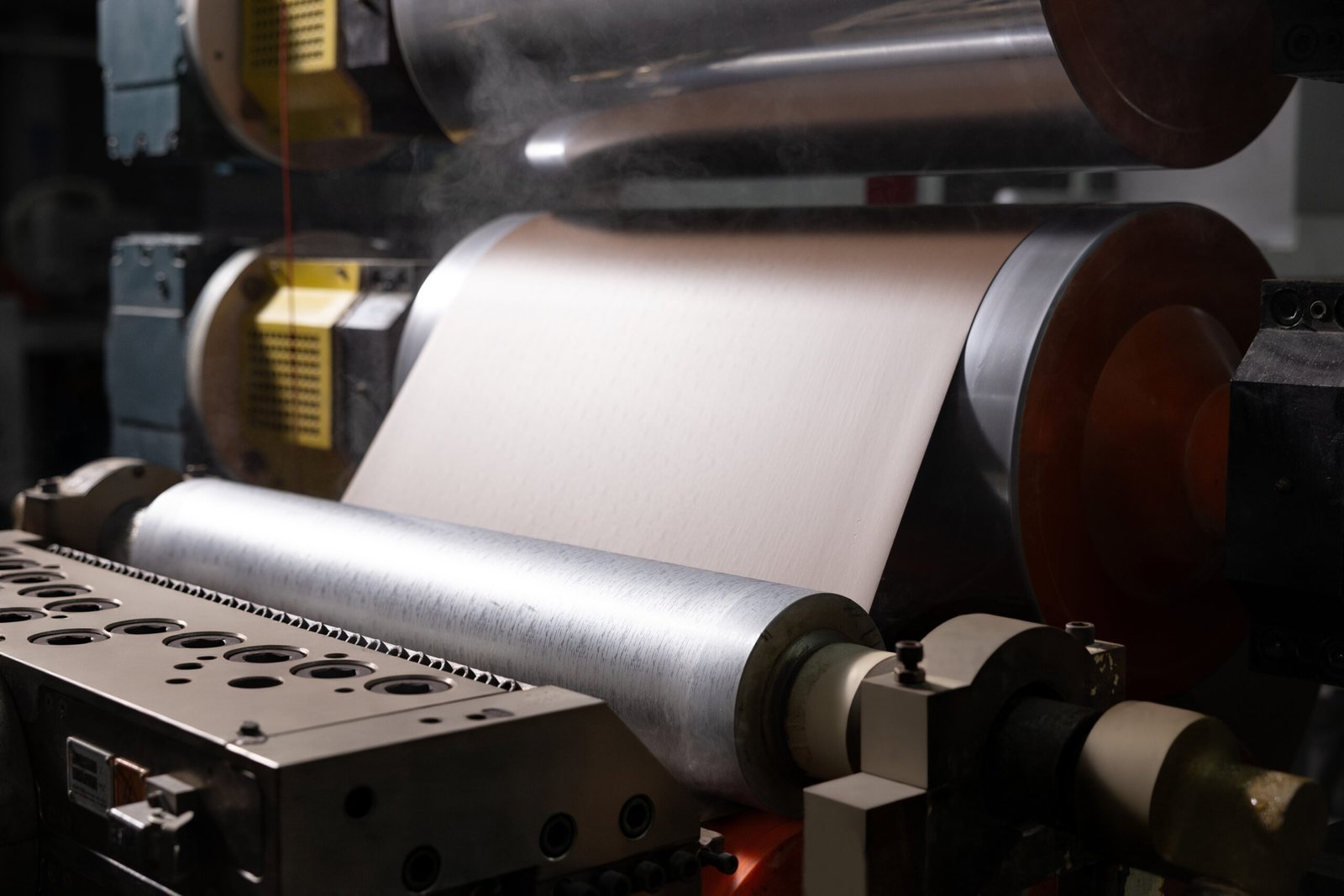

Process improvements: laser edging, PUR adhesives, QA data

- Laser / zero-gap technology creates cleaner joints and fewer visual seams.

- PUR adhesives improve bond strength in humidity.

- Documented QA (humidity cycle tests, peel tests) wins export buyers and big local chains.

I find the biggest returns come from combining these three buckets. Offer matched aesthetics, proven performance, and traceable test data. That triple offer converts architects and large buyers.

Key Growth Markets for Edge Banding in South America (2025–2030)?

Not all countries move at the same pace. Some markets will grow faster, and some niches will pay more for premium edges.

Brazil is the largest market by volume and design influence. Chile and Colombia show strong urban growth. Peru and Argentina have rising middle classes buying new furniture. Export-oriented factories also create pockets of high demand in coastal manufacturing hubs. Market reports show steady CAGR across Latin America, signaling a clear opportunity for edge band suppliers.

Dive deeper — country-by-country opportunities and go-to-market moves

I break opportunities into three types: volume markets, premium-niche markets, and export/support hubs.

Volume markets — Brazil and Argentina

- Why they matter: large populations and big domestic production lines.

- What to sell: cost-effective PVC and PP edges for kitchen and home furniture.

- Go-to-market: local reps, competitive pricing, fast coil supply. Offer MOQ-friendly packs and clear lead times.

Fast-growth urban markets — Chile, Colombia, Peru

- Why they matter: fast urbanization, rising middle class, e-commerce growth.

- What to sell: mid-range edges with good design options and durability. Digital printing and custom samples sell well here.

- Go-to-market: partner with furniture makers and designers, provide digital catalogs and sample kits.

Premium and export hubs — coastal manufacturing clusters

- Why they matter: factories that export to US/EU demand consistent specs and certified materials.

- What to sell: PUR-bond compatible edges, low-VOC materials, laser-ready strips.

- Go-to-market: offer test reports, adhesive pairing recommendations, and export documentation. This builds trust quickly.

I track a few KPIs to decide where to push next:

- local furniture production growth rate,

- number of new housing starts,

- e-commerce furniture sales growth,

- presence of export-oriented factories.

When I see two or more KPIs rising in a country, I increase marketing spend and stock there. This data-driven approach helps avoid wasted inventory and speeds orders.

How Local Distributors and Manufacturers Can Leverage These Trends?

You can act now. Small steps give quick wins. Bigger steps get bigger margins.

Distributors should add design-matched samples and easy online ordering. Manufacturers should test a few higher-grade edge profiles and switch adhesives for humid lines. Train salespeople to sell durability, not just price.

Dive deeper — practical playbook: products, pricing, partnerships, and marketing

I use a four-part playbook: Product tiering, sample-first sales, technical support, and sustainability proof.

1) Product tiering

Offer three clear tiers:

- Basic — low-cost PVC for volume lines.

- Plus — ABS/PP or high-grade PVC for daily-use furniture.

- Premium — wood-veneer, laser-ready, or digitally printed edges for designers and exports.

Each tier has a clear spec sheet and price band. This removes guesswork for buyers.

2) Sample-first sales model

Send matched edge samples with quick lead times. I include a small humidity-exposure report with each sample. This short test helps buyers feel safe to switch. It also shortens sales cycles.

3) Technical support and training

Offer machine-setting cheat sheets, adhesive pairing charts, and short on-site training. For humid climates, recommend PUR or tested EVA grades and show the exact machine temperature and speed you used on the sample.

4) Sustainability and documentation

Start collecting material safety data sheets, VOC test results, and recycling info. Many buyers ask for proof. Even a simple one-page certificate increases trust.

I add a marketing angle: show “local case studies” with before-and-after photos and short metrics (returns cut by X%, complaints down Y%). That converts better than generic claims.

Finally, I keep stock for small-batch custom orders. Designers and small manufacturers often want 50–200 meters of a custom print. If you can serve that quickly, you win those niche customers.

Sustainable and Digital Manufacturing: The Next Competitive Edge?

Sustainability and digital tech will separate winners from losers. Buyers will pay for lower emissions, safer materials, and exact matches. Digital printing and laser edging are key tools.

Edge band suppliers that offer greener materials and on-demand printing will capture premium channels. PUR adhesives and laser bonding reduce visible seams and improve life in humid climates. These features help you win export orders and high-end local clients.

Dive deeper — technologies to adopt, cost vs. ROI, and quick pilot ideas

I focus on three technologies and practical pilots you can run now.

Technology 1 — Digital printing on edge tape

- Why it matters: exact color and texture match; low MOQ; faster sample approval.

- Pilot idea: print 10 custom samples for a designer partner. Log approval time and order conversion rate.

Technology 2 — Laser / zero-gap edge bonding

- Why it matters: cleaner joints and perceived higher value. It also reduces post-processing time.

- Pilot idea: buy or partner for a small laser unit. Use it on 100 cabinets and measure finish time saved.

Technology 3 — Eco-friendly materials and adhesives

- Why it matters: export buyers and conscious local customers ask for this. Some markets reward it with better margins.

- Pilot idea: switch one SKU to low-VOC PVC or recycled PP and run a 3-month test with a national chain.

Cost vs ROI

- Digital printing and small laser units have upfront cost. But they reduce returns and win higher-margin orders.

- PUR adhesives cost more per kg. They cut rework in humid climates. For many contractors, the net savings justify the purchase.

I track ROI by these metrics:

- reduction in returns (%),

- increase in average order value,

- win rate on designer/architect bids.

When these move in the right direction after a pilot, I scale the investment.

Conclusion

South America offers steady growth and clear edge banding chances. Match design trends, prove durability, and adopt digital and green tech to win through 2030.

Data sources and links

- MarkNtel Advisors — Latin America Furniture Market (market size and CAGR). (MarkNtel Advisors)

https://www.marknteladvisors.com/research-library/latin-america-furniture-market.html - Market Research Future — Latin America Edge Banding Materials Market (regional edge band market forecast). (市场研究未来)

https://www.marketresearchfuture.com/reports/latin-america-edge-banding-materials-market-32287 - IMARC Group / CoherentMarketInsights — Edge Banding Materials Market (global trends and CAGR). (IMARC Group)

https://www.imarcgroup.com/edge-banding-materials-market

https://www.coherentmarketinsights.com/industry-reports/edge-banding-materials-market - The Business Research Company — PUR Hot-Melt Adhesives Market (growth of PUR adhesives in furniture). (市场研究公司)

https://www.thebusinessresearchcompany.com/report/pur-hot-melt-adhesives-global-market-report - Industry design trend sources — HipLatina and design journals on 2025 trends (natural textures, sustainability). (HipLatina)

https://hiplatina.com/2025-interior-design-trends-becky-g-walmart/

https://www.urbannatural.com/blogs/journal/the-top-7-furniture-design-trends-for-2025